Orlando is one of the most visited tourist destinations in the world, which makes it return potential for vacation rentals in Orlando extremely attractive to foreign investors.

Want to understand the complete real estate investment process in Orlando? Discover all the steps in our complete guide for Brazilian investors.

The proximity to theme parks like Disney and the constant flow of visitors increase the demand for alternative accommodations.

In this guide, we explore the advantages of this market, the best regions to invest in, and strategies to maximize profits from vacation rentals.

In this article you will find a detailed analysis of the return potential for vacation rentals in Orlando. We will address:

- Advantages of Investing in Vacation Rentals in Orlando: Discover the main benefits of the seasonal real estate market, including appreciation and high tourist demand.

- Return on Investment (ROI) Analysis: Understand how to calculate expected return and what can influence profits from vacation rentals.

- Best Areas to Invest: Discover the most promising regions, such as Kissimmee and Lake Buena Vista, and what makes these areas attractive for renting.

- Strategies to Maximize Return: From professional property management to pricing strategies, learn how to optimize your profits.

- Costs and Risks: Explore additional costs and discover how to mitigate risks, ensuring greater security and sustainability in your investment.

Advantages of Investing in Vacation Rentals in Orlando

1. High Tourist Demand

Orlando welcomes millions of tourists annually, seeking comfortable and affordable accommodations. Vacation rentals particularly attract families and groups, who prefer accommodation options with more space and privacy.

2. Continuous Real Estate Appreciation

In addition to the financial returns from vacation rentals, Orlando properties have appreciated in value in recent years due to urban development and the expansion of residential and commercial areas. This offers investors an opportunity for long-term profit, increasing the property's value over the years.

3. Flexibility and Personal Use

Investing in a vacation rental in Orlando allows the owner to enjoy the property during specific periods, using it for personal leisure without losing the potential financial return. This flexibility is a particular attraction for investors who want to combine vacations with profitable investments.

Return on Investment Analysis for Vacation Rentals in Orlando

The return on investment (ROI) for vacation rentals in Orlando can be quite positive, varying depending on location, occupancy rate, and property management. On average:

- High Occupancy Rate: High tourist demand guarantees an occupancy rate of 70% to 90%, especially during school holidays and public holidays.

- Competitive Daily Rates: In areas near the parks, daily rates can range from $150 to $400, depending on amenities and time of year.

- Average Annual Return: Investors with well-located and well-managed properties can obtain an annual return of between 8% and 12%, after deducting management and maintenance costs.

Want to better understand the applicable terms and taxes? Consult our complete glossary of real estate terms and make more informed choices.

Best Areas to Invest in Vacation Rentals in Orlando

Kissimmee

Kissimmee is famous for its proximity to Disney and attracts tourists looking for accommodations near the parks. The area has several condominiums aimed at seasonal rentals, offering good infrastructure and security.

Lake Buena Vista

Just minutes from Disney Springs, Lake Buena Vista is a highly valued area sought after by tourists. Properties in this area are experiencing high demand and growing appreciation.

Celebration

The city of Celebration, planned by Disney, is known for its quality of life and architectural charm. It's an ideal area for investors seeking differentiation and consistent property value.

Downtown Orlando

For those seeking a more urban experience, downtown Orlando offers attractions such as nightlife, culture, and events. Although further away from the parks, it's a good option for tourists seeking an alternative stay.

Strategies to Maximize Return Potential for Vacation Rentals in Orlando

1. Hire a Professional Property Management Company

Count on a company specialized in property management is essential to keeping the property in excellent condition and providing excellent service to guests. These services include cleaning, maintenance, reservation management, and customer service, ensuring a satisfactory experience and increasing occupancy rates.

2. Advertising on Rental Platforms

To attract more guests, it is essential to be present on platforms such as Airbnb, Vrbo, and Booking.com. A well-designed listing, with quality photos and a comprehensive description, makes all the difference in capturing a traveler's interest.

3. Seasonally Adjusted Pricing

Orlando has both high and low seasons, and adjusting rates according to demand can optimize financial returns. During peak periods, such as summer and holidays, higher daily rates can be charged, while during low season, more competitive pricing helps maintain bookings.

4. Invest in Amenities and Upgrades

Differentiating your property with additional amenities, such as high-speed Wi-Fi, a full kitchen, a private pool, and modern decor, attracts more guests and adds value to the property. The better the guest experience, the more positive reviews you'll get, which increases bookings and returns.

Additional Costs When Investing in Vacation Rentals in Orlando

When calculating the potential return on vacation rentals in Orlando, it's important to consider the additional costs involved in managing the property:

- Condominium Fees: In many cases, there are condominium fees for maintenance of common areas, which vary between $100 and $500 per month.

- Cleaning and Maintenance: Cleaning and maintenance services between reservations are essential to ensure the quality of the property and guest satisfaction.

- Local Taxes and Fees: Vacation rentals are subject to rental taxes in addition to annual property taxes.

- Property Management Fees: Property management companies typically charge between 15% and 30% of rental revenue, covering services such as reservation coordination and guest support.

Invest in vacation rentals in Orlando is a promising opportunity for those seeking financial returns and asset appreciation. With a constantly expanding tourism market and high demand for alternative accommodations, Orlando stands out as one of the best regions for this type of investment.

Risks and Mitigation When Investing in Vacation Rentals in Orlando

Despite the potential returns for vacation rentals in Orlando, there are risks that can be mitigated with proper planning and management:

- Variation in Occupation: During low season, occupancy rates may decrease. Promotions and rate adjustments help attract guests during these periods.

- Competition: Competition in the vacation rental sector is intense. Differentiating your property with amenities and a strategic location can make all the difference.

- Property Wear and Tear: High guest turnover leads to increased wear and tear on the property. Maintaining a reserve for periodic repairs helps keep the property in good condition.

- Variation in Occupation: During low season, occupancy rates may decrease. Promotions and rate adjustments help attract guests during these periods.

Ready to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

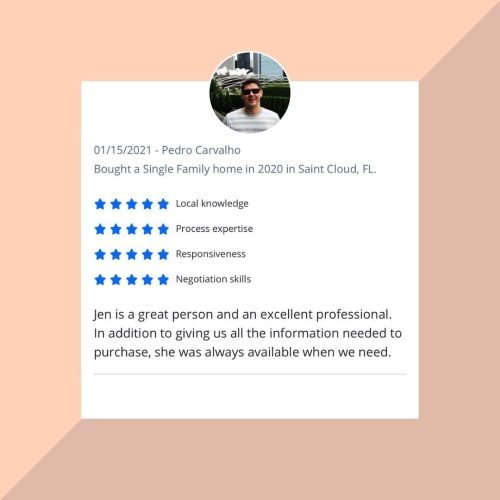

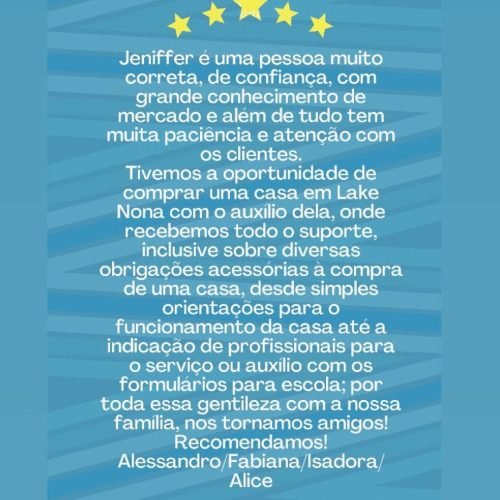

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025