Jen Dantas

Real estate broker in Orlando, specializing in the Florida real estate market.

- Want to generate passive income in dollars? While rental yields are low in Brazil, in Orlando, you can earn up to 10% per year. Find out how to invest!

If there's one thing I've learned over the years, it's this: relying solely on the Brazilian real to secure your financial future is risky. Inflation erodes, the currency fluctuates—and your hard-earned money loses purchasing power. Is there an alternative? Yes: passive income in dollars with properties in Orlando, in a solid and predictable market.

Key idea: dollarize part of the income + invest in real assets = more protection and predictability.

Profitability in Brazil: low returns and bureaucracy

If you've ever tried to invest in rental properties in Brazil, you know the obstacles: maintenance costs, leasing bureaucracy, risk of default, and lengthy repossession processes. The average return is around about 5% per year, often barely above inflation.

Passive income in dollars: the reality of real estate in Orlando

In Orlando, the scenario is more favorable. In long-term rentals, I see investors operating between ~7% and 10% aa (gross), with objective contracts and predictability of receivables.

- High demand for rent (long term and seasonal);

- Simple and secure rental process (clear contracts, lower risk of prolonged default);

- Occupancy rates consistent in strategic areas (e.g., Lake Nona, Kissimmee).

Observation: results vary by neighborhood, HOA, fees, property tax, insurance and management.

Traditional rental vs. Airbnb: which model is better?

Annual rental (Long-term)

Revenue stable, lower turnover, less day-to-day management.

Typical return: ~7%–10% per annum (gross) at good addresses.

Season (Airbnb)

Revenue potentially greater, but sensitive to occupancy, seasonality and platform rates.

Gross: can reach 18%–27%/aa; liquid usually stays in the range of ~10%–15% when well operated.

Quick comparison (gross, before expenses)

| Scenario | Property price | Monthly rent | Annual revenue | Profitability |

|---|---|---|---|---|

| São Paulo — annual rent | R$ 1,000,000 (~US$ 200,000) | R$ 4,200 (~US$ 840) | R$ 50,400 | ~5.0% per year |

| Orlando — annual rental | US$ 200,000 (~R$ 1,000,000) | US$ 1,600–1,800 | US$ 19,200–21,600 | ~9.6%–10.8% aa |

| Orlando — Season (Airbnb) | US$ 200,000 | US$ 3,000–4,500* | US$ 36,000–54,000* | Greater potential (depends on occupation/management) |

*Gross estimates. Cleaning, utilities, management, platform fees, taxes, and HOA costs impact the net cost.

Practical examples (round accounts)

1) Property in São Paulo (traditional rental)

Price: R$ 1,000,000 → Rent: R$ 4,200/month → R$ 50,400/year → ~5.04% per year (gross).

2) Property in Orlando (traditional rental)

Price: US$ 200,000 → Rent: US$ 1,600–1,800/month → US$ 19,200–21,600/year → ~9.6%–10.8% aa (gross).

3) Property in Orlando (Airbnb)

Revenue: US$ 3,000–4,500/month (variable occupancy) → gross of US$ 36,000–54,000/year. After expenses and management, liquid can be in the range of ~10%–15% per year when the product, location and operation are well aligned.

Want to create a dollar plan based on your profile? I simulate scenarios (annual x season), updated property list and real operating costs.

👉 Talk to meTransparency: Numbers are approximations for 2025; I confirm data updated at the time of the offer.

📚 Read also

How to Generate Passive Income in Florida

Practical guide to transforming properties into recurring income.

Dollarization of Assets with Real Estate in Orlando

Strategies to protect and multiply in hard currency.

How to Take Care of Your Florida Property While Living in Brazil

Remote operation, maintenance and management.

Frequently asked questions

Is it guaranteed to have 10% aa?

No. Returns depend on location, purchase price, occupancy, expenses, management, and interest rate scenario. I always run a conservative simulation.

Does Airbnb always make more money?

Not always. It may yield more in the gross, but it has seasonality and higher costs. For some profiles, annual rent is better.

Can foreigners finance?

Yes. There are lines for foreigners, with specific entry fees and fees. I evaluate the best structure on a case-by-case basis.

What costs to consider?

HOA, property tax, insurance, maintenance, management, utilities (in season), vacancy reserves and CapEx.

Notice: Educational content; it is not financial, legal, or tax advice. Investment decisions should be made with expert advice.

| Location | Property Price | Monthly Rental (Traditional) | Annual Profitability (Traditional) | Monthly Rental (Airbnb) | Annual Profitability (Airbnb) |

|---|---|---|---|---|---|

| Sao Paulo (BR) | R$ 1 million (~US$ 200 thousand) | R$ 4,200 (~US$ 840) | 5,04% | R$ 8,000 - R$ 12,000 (~US$ 1,600 - US$ 2,400) | Up to 10% |

| Orlando (USA) | US$ 200 thousand (~R$ 1 million) | US$ 1,600 - US$ 1,800 (~R$ 8,000 - R$ 9,000) | 9% - 10,8% | US$ 3,000 - US$ 4,500 (~R$ 15,000 - R$ 22,500) | Up to 15% |

2025: The right time to get in the game

The Orlando real estate market remains strong, and contrary to popular belief, there are still strategic opportunities for discerning investors.

With housing inventories at a high level, buyers have more negotiating power.

Furthermore, forecasts indicate that as the US economy stabilizes, appreciation will accelerate again. In other words, Those who buy now can guarantee an interesting return in the coming years.

If you are looking for smart investing, asset protection and passive income, dollarization of assets with properties in Orlando may be just what you need.

Protect your capital, take advantage of tax advantages, and be part of a globalized market that continues to grow. The time to act is now.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Real Estate Agent in Orlando Makes the Home Buying Process Easier

Buying a property in the US can be challenging, but Jen Dantas, a Brazilian real estate agent in Orlando, simplifies the process and will take care of everything you need to buy a property:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

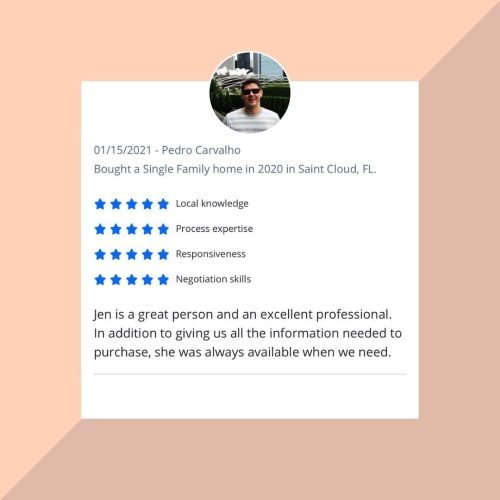

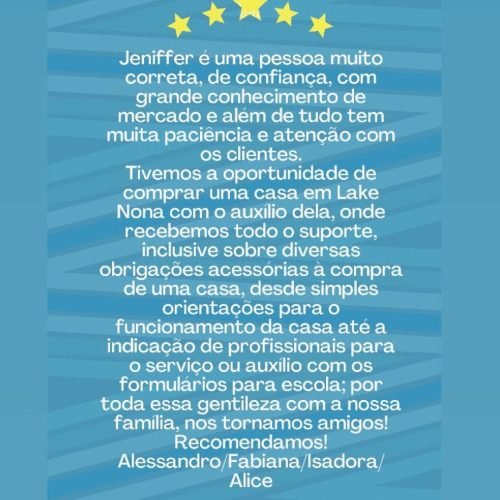

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025