Jen Dantas

Real estate broker in Orlando, specializing in the Florida real estate market.

- Discover how to finance a property in Florida as a foreigner. See the complete step-by-step guide to getting approved and making your dream come true!

If you think financing a property in Florida as a foreigner is complicated, let me tell you something: it's simpler than you think! 😎

Many Brazilians think that buying a house in the United States requires paying everything upfront — but that's not true. With a reasonable down payment and the right documents, you can finance your property in Florida with much more attractive rates than in Brazil.

And today I'm going to show you the step by step to do this safely and confidently. Let's do this together? 🚀

Why Is It Worth Financing a Property in Florida? 💰

If you're looking for a smart way to invest in real estate in the US, financing is an excellent strategy. Here are the main reasons:

✅ Competitive interest rates: Rates for foreigners are around 6.5% per year, much lower than those of the Brazilian market.

✅ Minimum accessible entry: Many banks only require 30% to 40% input for foreigners.

✅ Long terms: Financing can be done in up to 30 years, which greatly reduces the value of the installment.

✅ You can keep part of your invested capital: Instead of paying for the property upfront, you can use this amount to diversify your investments and maximize your return.

🔎 Jen's Tip: “With financing, you can buy 2 properties instead of 1 outright and double your passive income!”

Step 1: Choose the Property and Evaluate Your Financial Profile 🏠

Before starting the financing process, it is essential:

✅ Define the property value that you intend to purchase.

✅ Estimate the value of the entry (normally 30% to 40% of the total amount).

✅ Check your goal: Will the property be used as a residence, investment, or vacation rental? This decision can influence financing terms.

💰 Example: For a property of US$400,000, you would need to make a down payment of about US$120,000 (30%).

🔎 Jen's Tip: “Real estate near Disney, in Kissimmee or Lake Buena Vista, have a high demand for seasonal rentals — which helps pay the installments with the property’s own income.”

Step 2: Get a Pre-Approval Letter 📋

The pre-approval letter is essential to show the seller that you have the financial means to close the deal — and it also helps you know how much you can invest.

📋 Documents Required for Pre-Approval:

✅ Valid passport.

✅ Proof of income (such as income tax returns or pay slips in Brazil).

✅ Recent bank statement.

✅ Proof of address.

✅ Bank reference letter (issued by your bank in Brazil).

🔎 Jen's Tip: “The pre-approval letter greatly speeds up the process and gives you an advantage in the negotiation.”

Step 3: Choose a Bank or Financial Institution 🏦

The United States offers several financing options for foreigners. The best choices tend to be:

✅ Traditional banks as Bank of America, Chase and Wells Fargo.

✅ Specialized institutions in financing for foreigners, such as Lima One Capital and Merrill Lynch.

✅ The traditional banks They usually offer lower rates, but are more demanding in their analysis.

✅ The specialized institutions tend to have faster and more simplified processes.

🔎 Jen's Tip: “Working with a specialized broker makes things much easier, as they can connect you directly with banks that finance foreigners.”

Step 4: Prepare Your Complete Documentation 🗂️

To ensure your financing is approved without any hassle, have these documents organized:

✅ Proof of Income: It can be an income tax return, bank statement or pay slip.

✅ Bank Reference Letter: Issued by your bank in Brazil to prove your financial history.

✅ Proof of Address: Electricity, water or telephone bill.

✅ Valid Passport: Essential document to prove your identity.

✅ Proof of Entry: The bank will require you to prove that you already have the down payment available.

🔎 Jen's Tip: “Prepare your documentation in advance to speed up the process—this shows that you are a prepared and organized buyer.”

Step 5: Property Appraisal and Approval 🏚️

After your documentation is approved, the bank will request a professional evaluation (appraisal) of the property you have chosen. This step is important because:

✅ Ensures that the property value is in line with the financing amount.

✅ Protects you from paying above market price.

🔎 Jen's Tip: “Even if you're buying outright, getting an appraisal is a great way to ensure you're paying a fair price.”

Step 6: Contract Signing and Closing ✍️

This is the final step, where you sign the documents that formalize the financing and purchase of the property.

✅ During closing, you will need to pay the closing fees (closing costs), which generally vary between 2% and 5% of the value of the property.

✅ The process can be done remotely with a power of attorney or digital signature, if you are in Brazil.

🔎 Jen's Tip: “Hiring a specialized attorney during the closing process can help you understand all the legal details and avoid surprises.”

Step 7: Strategy for Paying Installments with Your Own Property 💡

This is the part that many investors love! 😎

If you have chosen a strategic property for vacation rental, it is possible that the property itself will generate enough income to cover a large part (or even 100%) of the financing installments.

💰 Simulation Example:

✅ Property financed in the amount of US$1,000,000.

✅ Monthly installment: US$1,770/month.

✅ Average vacation rental revenue (Airbnb/VRBO): US$3,500/month.

✅ Result: You pay the installments with part of the profit and still generate extra income!

🔎 Jen's Tip: “Properties in areas such as Kissimmee, close to Disney, have a high occupancy rate — ideal for covering mortgage payments with rent.”

Conclusion: Financing a Property in Florida is Simpler Than It Seems 🚀

With an affordable down payment, attractive interest rates, and long repayment terms, financing a property in Florida could be the key to achieving your dream home or boosting your equity with a passive income in dollars.

💬 Need help finding the right property and facilitating your financing? Call me and I'll explain everything and put you in touch with the best banks and experts in the market!

Let's make this dream a reality? 🚀🏡

Read also:

➡️ How to Generate Passive Income in Florida

➡️ Investing in a Vacation Home in Orlando

➡️ Dollarization of Assets with Real Estate in Orlando

2025: The right time to get in the game

If you are looking for smart investing, asset protection and passive income, dollarization of assets with properties in Orlando may be just what you need.

Protect your capital, take advantage of tax advantages, and be part of a globalized market that continues to grow. The time to act is now.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Real Estate Agent in Orlando Makes the Home Buying Process Easier

Buying a property in the US can be challenging, but Jen Dantas, a Brazilian real estate agent in Orlando, simplifies the process and will take care of everything you need to buy a property:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

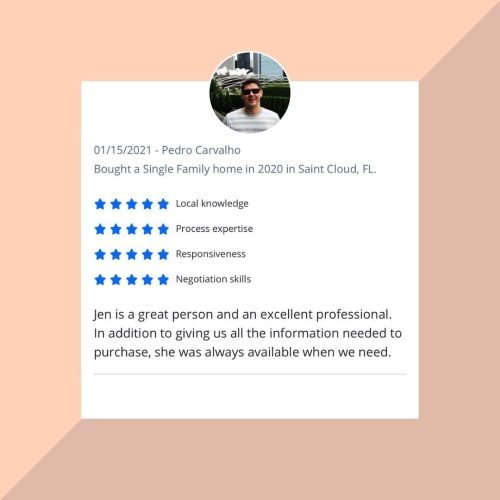

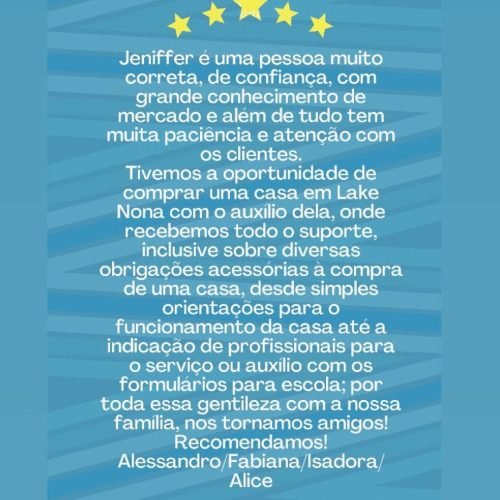

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025