Jen Dantas

Real estate broker in Orlando, specializing in the Florida real estate market.

- Learn the step-by-step process for buying a home in Florida in 2025. Practical tips for Brazilians, from pre-approval to closing the deal!

Have you ever imagined yourself with a house in Florida, close to Disney and the most incredible beaches in the United States?

Well... I've been there too, full of doubts about the process, the costs, and the bureaucracy. But let me tell you: it's much simpler than it seems — as long as you know where to start!

If you dream of investing or living in Florida, this guide will show you how step by step guide to buying a home in Florida in 2025, highlighting the precautions that every Brazilian should take to avoid problems.

Why Buying a House in Florida in 2025 Is a Good Idea?

If you are thinking: “But is now a good time?”, the answer is YES! And here are some reasons why:

✅ The Florida housing market is stable, with higher inventory and more balanced prices — that is, more chances to negotiate a great value.

✅ The average house price is around US$420,000, with appreciation of +2,4% in 2024.

✅ Condominiums and townhouses have high inventory, creating an excellent opportunity to purchase at a discount.

✅ Orlando's tourism market remains buoyant, ensuring high demand for vacation rentals.

Now that you know that 2025 is an excellent window of opportunity, let's take a step-by-step look at how to make this dream come true!

Step 1: Financial Planning and Pre-Qualification

Here's a golden tip: Before you start looking for properties, organize your finances. This step is essential to avoid frustration and ensure you're ready to move forward.

🔹 Financial Pre-Qualification: In the American market, it is common for the process to begin with financial approval. For foreigners, the minimum down payment is usually 30% to 40% of the value of the property.

🔹 Required Documents for Brazilians:

✅ Valid passport.

✅ Proof of income (IR in Brazil, bank letter or statements).

✅ Recent bank statement.

✅ Credit history (if available).

🔎 Jen's Tip: “Getting a pre-approval letter gives you more negotiating power with sellers and speeds up the process when you find the ideal home.”

Step 2: Choosing the Region and Property Type

Now that you're pre-approved, it's time to choose where you want to live or invest.

🏡 Best Regions for Brazilians in 2025

📍 Orlando: Ideal for families and those looking for proximity to theme parks.

📍 Kissimmee: Excellent for vacation rentals, with a high occupancy rate.

📍 Davenport and Haines City: Growing regions, with more attractive prices.

📍 Windermere and Celebration: Premium options, with high appreciation potential.

🏢 Types of Properties

✅ Single-Family Homes: Perfect for housing and large families.

✅ Condominiums and Townhouses: Easier to manage and ideal for vacation rentals.

🔎 Jen's Tip: “Consider condos if you're looking for profitability and flexibility, as high inventory in 2025 allows for more aggressive negotiations.”

Step 3: Make an Offer and Negotiate

Once you've found your dream property, it's time to make an offer.

✅ The proposal (offer) must contain:

- Offer value.

- Deadline for seller's response.

- Specific conditions, such as deadline for inspection or financing.

🔎 Jen's Tip: "With inventory levels higher in 2025, many sellers are more open to negotiation. Use this to your advantage!"

Step 4: Inspection & Appraisal

This is one of the most important steps and one that many Brazilians are unaware of.

✅ Inspection: Assess the general condition of the property (structure, plumbing, electrical, etc.). This is essential to ensure you don't end up with a headache.

✅ Appraisal: If you are financing, the bank will require an appraisal to confirm that the property's value is appropriate for the market.

🔎 Jen's Tip: “Never skip an inspection! It can reveal hidden problems that could save you thousands of dollars in the future.”

Step 5: Financing and Documentation

For foreigners, financing in Florida is simpler than it seems. Banks usually ask for:

✅ Minimum deposit of 30% of the value of the property.

✅ Average interest rate around 6,5%.

✅ Deadlines of up to 30 years, facilitating cash flow for investors.

🔎 Jen's Tip: “If you're thinking about investing, financing can be a great strategy to leverage your assets and ensure good profitability.”

Step 6: Closing

THE closing It's the big moment! Here the property is officially transferred into your name.

✅ It is necessary to sign the final documentation (which can be done in person or online).

✅ Closing rates usually vary between 2% and 5% of the value of the property.

🔎 Jen's Tip: "The closing can be done remotely with a power of attorney or electronic signature. Ideal for those in Brazil!"

Common Mistakes You Should Avoid

❌ Skip prequalification: Without this, you may waste time analyzing properties outside your budget.

❌ Ignore the additional costs: In addition to the property price, remember to calculate HOA (condominium fees), insurance, and taxes.

❌ Not planning property management: If you live in Brazil, it's essential to hire a company to manage your property and ensure its profitability.

Conclusion: 2025 is the Right Year to Make Your Dream in Florida Come True!

Buying a home in Florida in 2025 is easier than it seems—as long as you're prepared and follow each step carefully.

If you are thinking about investing or moving to Florida, I'm here to help you!

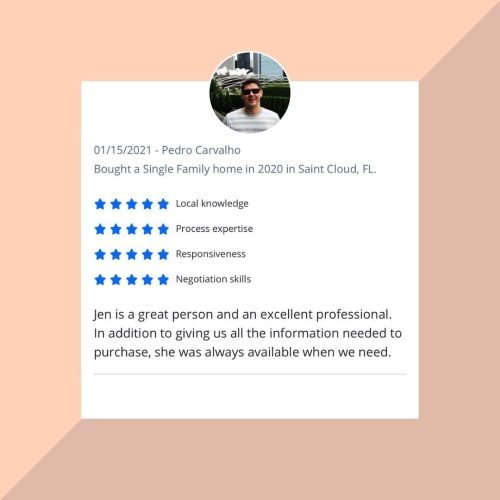

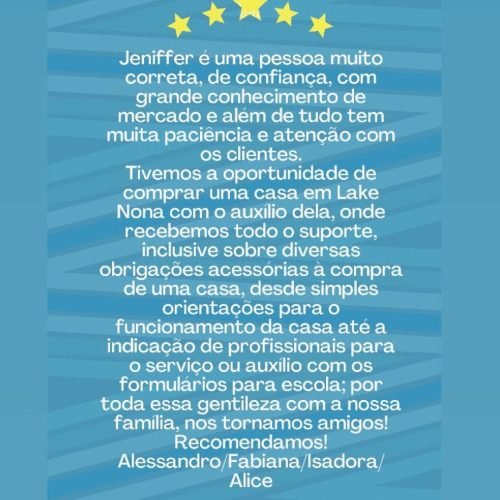

I've already helped many Brazilians to find the ideal home and I would love to be part of this achievement with you.

Want me to send you some options that fit your profile and budget? Contact me and let's talk! 😊

2025: The right time to get in the game

The Orlando real estate market remains strong, and contrary to popular belief, there are still strategic opportunities for discerning investors.

With housing inventories at a high level, buyers have more negotiating power.

If you are looking for smart investing, asset protection and passive income, dollarization of assets with properties in Orlando may be just what you need.

Protect your capital, take advantage of tax advantages, and be part of a globalized market that continues to grow. The time to act is now.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Real Estate Agent in Orlando Makes the Home Buying Process Easier

Buying a property in the US can be challenging, but Jen Dantas, a Brazilian real estate agent in Orlando, simplifies the process and will take care of everything you need to buy a property:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025