Jen Dantas

Real estate broker in Orlando, specializing in the Florida real estate market.

- Discover how the strong dollar can boost your Florida real estate profits! See practical strategies and real-world simulations to help you earn more.

Have you ever considered that the strong dollar could actually be an excellent investment opportunity? 🤔

I know, it sounds strange... After all, with the dollar hitting record highs, many people think investing in the US is risky. But let me tell you something I've discovered over the years: Investing in real estate in Florida with the high dollar can multiply your earnings surprisingly — and I'll explain how!

I myself have thought: “Is it worth investing now?”

And it was only when I saw my clients making a lot of money during the strong dollar that I realized: This may be the best time to invest in Florida real estate!

Why Can the High Dollar Be an Ally (And Not a Villain)?

Let's get straight to the point: when the dollar rises, your dollar-denominated property can become an even greater source of income.

And here's why:

💰 Dollarized Passive Income: Rents received in dollars are worth even more when converted to reais.

📈 Protected Valuation: Florida real estate prices tend to follow the strengthening of the US currency, protecting your assets.

🌍 Growing Tourist Demand: Even with the high dollar, Orlando continues to receive millions of tourists, boosting demand for vacation rentals.

In other words, you benefit from both the appreciation of the property and the exchange rate.

And the stronger the dollar, the greater your profit in reais!

Real Example: How the High Dollar Multiplies Your Earnings

Let's get practical! Imagine you have a property in Orlando rented for US$1,500/month.

🔹 If the dollar is R$5.00, you would receive:

US$2,500 x R$5.00 = R$12,500/month

🔹 If the dollar rises to R$6.00, without the rent changing, you are now receiving:

US$2,500 x R$6.00 = R$15,000/month

💥 In other words, even without increasing the rent, you are earning R$2,500 more per month just because of the appreciation of the dollar!

Now, think about this in the long run: in one year, this difference would generate an additional profit of R$30,000 only with currency conversion.

🔎 Jen's Tip: "Investing in real estate in Florida is a smart way to protect your assets from the devaluation of the real and guarantee extra income whenever the dollar rises."

3 Strategic Reasons to Invest in Florida Real Estate Now

In addition to the positive impact of the strong dollar, there are other factors that make 2025 a strategic year to invest:

1. Balanced Real Estate Market

📊 The average home price in Florida is around US$420,000, with a moderate appreciation of +2,4%.

🏢 The high stock of condominiums and townhouses create great opportunities to negotiate discounted properties.

2. High Profitability with Rentals

💰 Single-family homes offer an average return of ~7.1% per year.

💰 Condos and townhouses arrive ~7.5% per year, being able to exceed 10% in the most popular tourist regions.

3. Growing Demand for Vacation Rentals

🌴 Florida remains one of the most visited tourist destinations in the world.

🌍 With occupancy rates between 70% and 80% In Orlando, revenue from vacation rentals continues to rise.

Strategies to Maximize Your Profits with the High Dollar

Want to make the most of the favorable exchange rate? Here are some strategies that can boost your profits:

✅ Invest in Tourist Regions: Areas such as Kissimmee, Lake Buena Vista and Davenport attract tourists all year round, ensuring high occupancy rates.

✅ Invest in Vacation Rentals: This modality generates higher revenue and adapts well to the increase in the dollar exchange rate.

✅ Take advantage of Real Estate Financing: Even with the strong dollar, financing for foreigners in the US offers competitive rates, around 6.5% per year, with a deadline of up to 30 years.

🔎 Jen's Tip: “In periods of high dollar, seasonal rentals become even more profitable, because your property yields more when converted to reais.”

Strategy Example: Buying with a High Dollar and Selling with Appreciation

Imagine you buy a property in Orlando today for US$400,000 with the dollar at R$5.50.

🔹 Initial investment:

US$400,000 x R$5.50 = R$2,200,000

Now, let's say you resell this property in 3 years for US$450,000 and that the dollar has risen to R$6.00.

🔹 Resale value in reais:

US$450,000 x R$6.00 = R$2,700,000

💥 Result: You had an exchange rate gain of R$500,000, in addition to the profit from the sale of the property.

Conclusion: The High Dollar Can Be Your Great Ally!

I know that for many Brazilians, the high dollar seems scary. But for those who understand the potential of real estate in Florida, this scenario represents an excellent opportunity.

The secret is to choose the right property, the right region, and the right strategy — and that's where I can help you. 😉

If you are thinking about protecting your assets and ensuring a source of passive income in dollars, call me that I help you find the best options!

The information presented in this article was based on data from the report “State of the Market – February 2025″ published by Orlando Regional REALTOR® Association (ORRA)

Take advantage of this opportunity and turn the strong dollar into your financial ally! 🚀

2025: The right time to get in the game

If you are looking for smart investing, asset protection and passive income, dollarization of assets with properties in Orlando may be just what you need.

Protect your capital, take advantage of tax advantages, and be part of a globalized market that continues to grow. The time to act is now.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Real Estate Agent in Orlando Makes the Home Buying Process Easier

Buying a property in the US can be challenging, but Jen Dantas, a Brazilian real estate agent in Orlando, simplifies the process and will take care of everything you need to buy a property:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

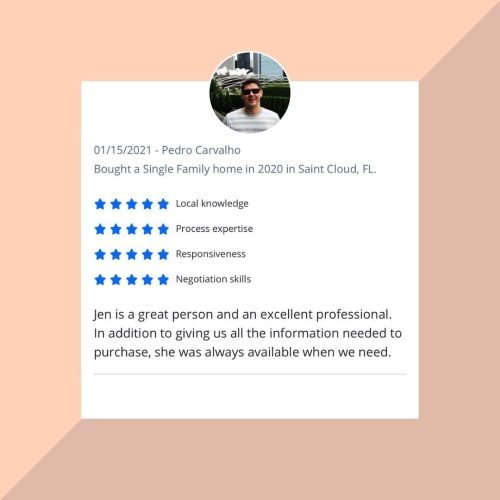

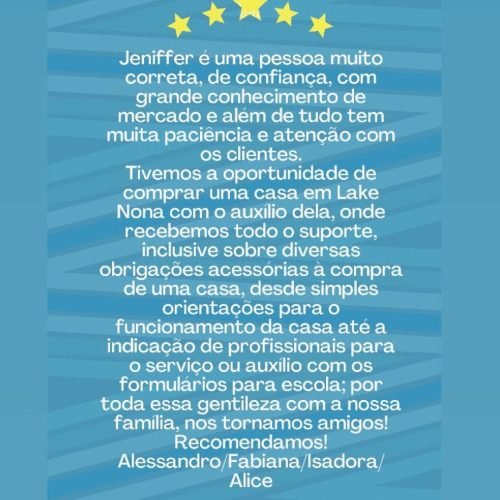

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025