Jen Dantas

Orlando real estate broker specializing in the Central Florida real estate market.

- Could Orlando become a tax haven for investors? See what changes with DeSantis' proposal and why you should act now!

Why is Dollarizing Now Strategic?

Before I talk about DeSantis, let me give you some context: it's July 2025, and the dollar remains strong. In Brazil, inflation is at 5,1%, while here in the US it revolves around 2,7%.

And the real? It continues to lose value – Brazilian public debt has gone from 76% of GDP and analysts are already talking about 79% or more by the end of the year.

A dear client from São Paulo told me the other day:

“Jen, I left everything in reais thinking it would improve, but when the dollar went from R$$5.55 to R$$6.30 at the end of 2024, my wealth evaporated.”

This is more common than it seems.

When I arrived here, I bought my first house in Orlando and saw my assets grow in dollars, even with Brazil facing several political and economic uncertainties.

Now imagine combining this with less tax to keep the property? That's where DeSantis' proposal comes in.

📉 The Proposal: Less Taxes, More Returns

In March 2025, Governor DeSantis announced a proposal that could revolutionize the landscape for Florida homeowners:

✅ Rebate of US$1,000 in December 2025 for those who have a main residence (homestead)

✅ Exemption of up to US$1,000,000 in the value of the property (or US$1 million if you are elderly)

✅ Assessment limit: annual appreciation limited to 15%

✅ Plan to eliminate property taxes entirely by 2026

This may represent a savings of up to US$1,800 per year in a property worth US$1,000,000 – not bad, right?

Not to mention the positive impact on net profitability for those who invest with a focus on rentals.

And the Orlando Market, how is it?

Just look at the data from June 2025:

| Indicator | Value | Trend |

|---|---|---|

| Median Home Price | US$ 390,000 | Stable vs. May |

| House Inventory | 13.793 | -1.2% vs. May |

| Average Rent | US$ 2,000/month | +3–5% vs. 2024 |

| Average Time to Sale | 50 days | +22 days vs. 2024 |

Source: Orlando Regional REALTOR® Association / Zillow

In other words, the market remains buoyant, but there's room for negotiation. And if taxes are reduced, investors' net returns could increase even further!

Why Orlando?

💡 Florida's GDP is expected to grow 3.5% in 2025

💡 Orlando attracts millions of tourists a year

💡 Neighborhoods like Lake Nona and Winter Garden continue to appreciate

💡 Regions such as Kissimmee have a very high demand for seasonal rentals

💡 And don't forget: here there is no state income tax!

A couple from Curitiba that I recently helped bought a condo in Kissimmee to rent on Airbnb.

Today they have income in dollars and, with DeSantis' proposal, they are already calculating how this can boost their return.

⚠️ Are There Risks? Yes, and I Like to Be Transparent!

The biggest point of attention is: Where will the money that comes from taxes today come from?

Some experts suggest increasing the consumption (sales) tax, which could impact the cost of living. Others suggest an "entrance tax" for new residents.But be careful: this tax will probably would not apply to foreign investors, like you.

Furthermore, if tax cuts affect public services like schools or roads, this could affect the attractiveness of homes for buyers – but has little impact on those who focus on vacation rentals.

And for us, Brazilians?

You already know that investing in Orlando It's a smart way to protect your money. And with this proposal, the scenario becomes even more favorable:

✨ Dollarization: escapes the instability of the real

✨ Income in dollars: average rent of US$$ 2,000/month

✨ Tourism: very high demand all year round

✨ No state income tax: cleaner profit on rental and sale

✨ Projected valuation of 3.7% in 2025, with Orlando surpassing the national average

In Florida, the tourism-domestic migration combo maintains resilient demand even with high interest rates. Orlando, in particular, boasts:

Economic diversification (health-tech in Lake Nona, theme parks, logistics).

Gross profitability still above the national average, especially in Polk County and the suburbs south of I-4.

High liquidity: Mid-tier properties go into contract quickly.

2025: How to Seize the Moment?

If you're looking to buy, now's a great time to explore Florida real estate market trends and carefully evaluate your options.

Legal Notice: This article is for informational and educational purposes only and should not be construed as tax or financial advice. Tax laws are complex and constantly changing. Always consult a qualified professional, such as a CPA or tax attorney, to discuss your specific situation before making any investment decisions.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Brazilian Real Estate Broker in Orlando Facilitates the Real Estate Buying Process

Buying a property in the US can be challenging, but Jen Dantas, as an expert Brazilian real estate agent, simplifies the process and will take care of everything you need to buy a property in Florida:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- Documentation and support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

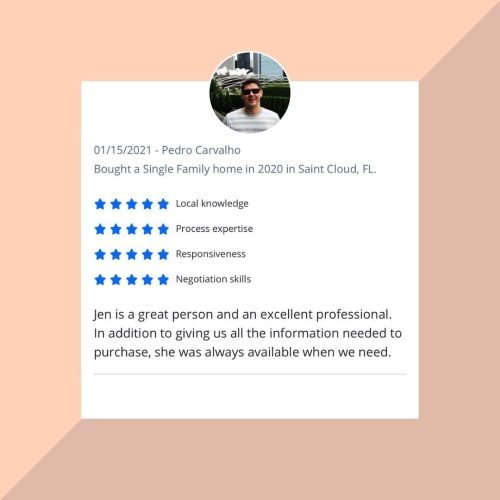

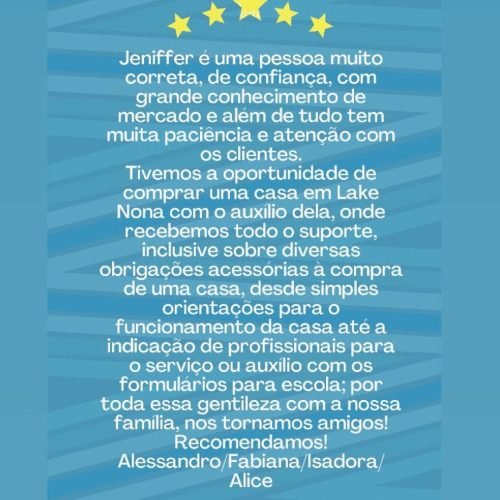

Stories of Conquest

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025