Jen Dantas

Orlando real estate broker specializing in the Central Florida real estate market.

- Discover how depreciation turns profit into a "loss" on paper and reduces (or eliminates) your US taxes. The tax trick few use!

Understand how depreciation works

Let me tell you a quick story about a client of mine, Mariana. She bought her first rental property and was thrilled. After a few months, she saw the money rolling in and thought: “That’s it! I’m building wealth!”

But then, fear hit. She called me, a little panicked, and said:

"I see this profit, but what about the tax on all of this? Will I have to hand over a huge slice to the government?"

I smiled on the other end of the line, because I knew I was about to introduce Mariana to what I call the real estate investor’s “superpower.” It's a concept that, at first glance, seems complicated, but is actually the most powerful tool we have to legally reduce (or even eliminate) our taxes.

This superpower is called depreciationAnd if you, like Mariana, are profiting from real estate but worried about taxes, pull up a chair. I'll explain this to you in a way even a 10-year-old could understand.

What is depreciation, anyway? Think about a work truck.

Imagine you buy a brand-new pickup truck for $50,000 to use in your business. You and the government know that in five years, that pickup truck won't be worth $50,000 anymore. It will have scratches, the engine will be more worn, the tires will be bald. It will wore out.

The IRS understands this and tells you:

“Look, since this pickup truck is an asset to your business and is wearing out, I’m going to let you deduct a portion of its value as an expense each year.”

Now, apply this same logic to a property.

When you buy a house or apartment, the land itself doesn't wear out. But what about the building? The roof ages, the plumbing deteriorates, the paint peels, the structure suffers over time. The building, like the pickup truck, is "wearing out."

Depreciation is simply the tax recognition of this wear and tear. It is a expense on paperNo one sends you a bill for this. No money comes out of your pocket. It's a "paper" deduction that the government allows you to use to reduce your taxable income. That's why it's a superpower.

How the magic happens in practice: A simple example

Let's use round numbers to make it easier.

Let's say you bought a property for US$ 300,000. The appraiser says the land is worth US$ 25,000 and the construction is worth US$ 275,000.

Remember, you can only depreciate the building, not the land. For residential properties, the government gives you a magic number: 27.5 years old — is the fiscal “useful life” of your property.

- Construction Value: US$ 275,000

- Divided by: 27.5 years old

- Your Annual Depreciation Deduction: US$ 10,000

Now comes the amazing part. Let's say that, after paying all expenses (financing, property tax, insurance), your property generated a profit of US$ 8,000 in the year.

When filing your taxes, you will do this:

- Real Profit (Cash Flow): + US$ 8,000

- Depreciation Deduction: – US$ 10,000

- Taxable Income: – US$ 2,000 (a loss on paper!)

That's right. You put US$ 8,000 in your pocket, but for the IRS you had a “loss” of US$ 2,000.

Result?

You don't pay a penny of tax on that profit. If you have a paying job, this "loss" can still be used to reduce the tax you pay on it.

Leveling Up: Cost Segregation and Bonus Depreciation

Ready for the next level of superpower?

The 27.5-year rule is a simplification. We know that the carpet in an apartment doesn't last 27.5 years. Nor does the refrigerator. Nor do the blinds.

This is where the Cost SegregationIt's like hiring an expert to "disassemble" your property on paper and place each piece in different time buckets.

- 5-year bucket: Carpets, appliances, blinds.

- 15 year old bucket: Land improvements such as fences, sidewalks, and landscaping.

- 27.5 year old bucket: The main structure of the building.

THE Bonus Depreciation is the turbocharger of this process. It allows you to take everything in the 5- and 15-year buckets and deduct 100% of the value in the first year.

Returning to our example of US$ 275,000, let's say that cost segregation finds US$ 50,000 on 5- and 15-year items. With the bonus depreciation of 100 %, your Year 1 deduction jumps to over US$ 58,000! This creates a massive paper loss, giving you immense tax-saving power.

A Word of Caution: The “Recapture” of Depreciation

Every superhero has his kryptonite. The depreciation one is called Depreciation Recapture.

It's simple: when you sell your property, the government basically says, "Hey, remember all that tax break I gave you for the 'wear and tear' on your building? Now that you're selling at a profit, I want some of that breakage back."

This portion is taxed at a maximum rate of 25% (slightly higher than the long-term capital gains rate). It's the price to pay for the benefit. The good news? There are strategies, such as 1031 Exchange, which allow you to defer payment of this recapture indefinitely by rolling your earnings over to a new property.

Putting It All Together

Depreciation isn't a loophole or a "quick fix." It's a fundamental and legal part of the tax code, designed to encourage investors like you and me to provide housing and improve properties.

This is why real estate investing is one of the most effective wealth-building tools available. It allows you to earn cash flow while, on paper, appearing to be losing money, shielding your hard-earned profits from taxes.

Mariana? Today she understands the power of depreciation. Not only does she continue investing, but she does so more intelligently, using this "superpower" to accelerate her journey toward financial freedom.

And you can too.

Read also: The One Big Beautiful Bill has passed – learn how it benefits real estate investors.

Legal Notice: This article is for informational and educational purposes only and should not be construed as tax or financial advice. Tax laws are complex and constantly changing. Always consult a qualified professional, such as a CPA or tax attorney, to discuss your specific situation before making any investment decisions.

2025: How to Seize the Moment?

If you're looking to buy, now's a great time to explore Florida real estate market trends and carefully evaluate your options.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Brazilian Real Estate Broker in Orlando Facilitates the Real Estate Buying Process

Buying a property in the US can be challenging, but Jen Dantas, as an expert Brazilian real estate agent, simplifies the process and will take care of everything you need to buy a property in Florida:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- Documentation and support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

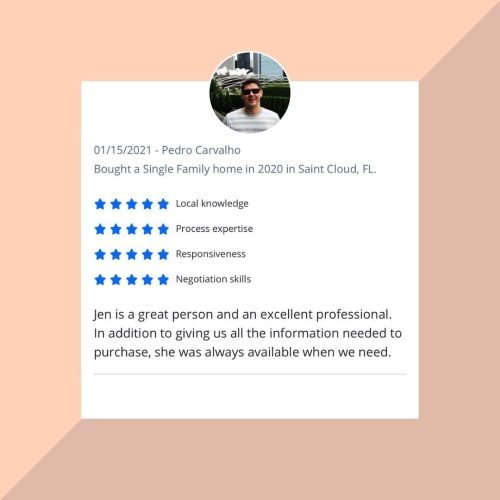

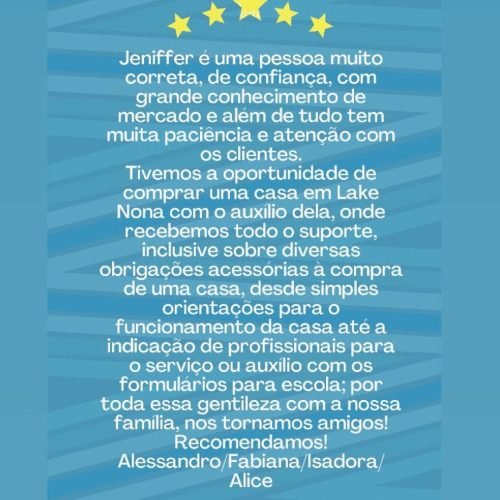

Stories of Conquest

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025