Discover the meaning of key US real estate terms in this comprehensive glossary, ideal for Brazilians looking to invest in Orlando.

Understand concepts like mortgages, escrows, cap rates, and more. Simplify your buying process and learn all about financing, fees, and zoning.

The real estate market in the United States, especially in Orlando, has become an attractive opportunity for Brazilian investors.

However, the buying and investing process can involve specific terms and concepts, usually in English, that can confuse even the most experienced.

With that in mind, we've prepared this comprehensive and detailed glossary of essential real estate terms.

This guide is designed to help you understand the technical vocabulary and simplify the process of buying and financing real estate in the US, making every step of your investment easier.

Take the opportunity to explore each term and increase your confidence in the American real estate market, with content that highlights the most relevant topics for Brazilians interested in investing in Orlando.

Know the key real estate terms in the US is essential for investing safely in the American market. Below, a practical glossary in Portuguese—with direct definitions and context—will help you navigate financing, appraisals, contracts, and property management.

Key US Real Estate Terms:

Value estimated by independent appraiser. Usage: required by the bank for financing.

Compare with recent sales. Usage: set fair price.

Financing ÷ property value. Usage: loan risk.

Debts ÷ income. Usage: credit approval.

Mortgage insurance with down payment < 20%. Usage: additional cost to the buyer.

Preliminary credit assessment. Usage: Strengthen your offer.

Costs to close the purchase. Usage: ~2–5% of value.

Custody account for the operation. Use: Holds funds/documents.

Sign of good faith. Use: makes up the final payment.

NOI ÷ price. Usage: rent return.

Revenue – operating expenses. Use: return base.

Cash inflow – cash outflow. Usage: investment health.

Tip: Save this section for quick reference during visits and negotiations.

Market & Indicators (USA)

- Absorption Rate

- Measures the speed at which properties are sold over a certain period. Usage: demand/stock reading.

- Appreciation

- Increase in the value of a property over time. Usage: capital gain.

- Capitalization Rate (Cap Rate)

- Annual return on a property: NOI ÷ price. Usage: Compare income assets.

- Cash Flow

- Revenue – operating/financial expenses. Use: investment sustainability.

- Cash-on-Cash Return

- Return on invested equity. Use: contribution efficiency.

- Gross Income Multiplier (GIM)

- Price ÷ gross annual income. Use: rapid profitability screening.

- Gross Rent Multiplier (GRM)

- Price ÷ gross annual rent. Usage: compare rental properties.

- Net Operating Income (NOI)

- Total revenue – operating expenses (excluding debt/taxes). Usage: Cap Rate basis.

- Vacancy Rate

- % of time without a tenant. Usage: Estimate revenue risk.

- Vacancy Provision

- Reserve to cover empty periods. Usage: smooth cash flow.

- Yield

- Annual return of % on the acquisition cost. Use: benchmark with other asset classes.

- Fair Market Value (FMV)

- Fair market price in a competitive environment. Use: tax and pricing basis.

- Real Estate Appreciation

- Asset value gain due to demand/improvements. Usage: long-term strategy.

Financing & Mortgages (USA)

- Adjustable-Rate Mortgage (ARM)

- Index-linked variable-rate mortgage. Usage: cheaper start, high risk.

- Fixed-Rate Mortgage

- Fixed rate for the entire term. Use: predictability of installments.

- Balloon Mortgage/Balloon Payment

- Smaller payments and large settlement at the end. Usage: plan exit/refinancing.

- Interest-Only Loan

- Initial period paying only interest. Usage: relieve box at the beginning.

- Assumable Mortgage

- Buyer assumes seller's mortgage. Use: useful in high interest cycles.

- Reverse Mortgage

- Credit for seniors backed by property. Use: liquidity without selling the house.

- HELOC

- Line of credit with equity guarantee. Use: renovations/investments.

- Conventional Loan

- Loan without federal agency guarantee. Usage: stricter criteria.

- FHA Loan

- FHA-insured financing; low down payment. Usage: access for 1st purchase.

- Portfolio Loan

- Loan maintained by the lender itself. Usage: more flexible for atypical profiles.

- Owner/Seller Financing

- Seller finances buyer directly. Use: bypasses banking barriers.

- Wraparound Mortgage

- Financing “wraps” around the existing mortgage. Usage: creative purchasing structure.

- Loan-to-Value (LTV)

- Financing ÷ property value. Usage: defines risk/conditions.

- Debt-to-Income (DTI)

- Monthly debts ÷ monthly income. Usage: credit approval.

- DSCR

- NOI ÷ debt service. Use: viability of income financing.

- PMI (Private Mortgage Insurance)

- Insurance required with down payment < 20%. Usage: extra monthly cost.

- Pre-Approval

- Preliminary credit assessment. Use: streamlines and strengthens offers.

- Negative Amortization

- Installment does not cover interest; balance increases. Usage: pay attention to the total cost.

- Mortgage

- Mortgage with the property as collateral. Usage: up to ~80% of value, common case.

Documents & Title

- Deed

- Document that transfers ownership. Use: official record.

- Quitclaim Deed

- Transfers interest without guarantees. Usage: family/heritage.

- Special Warranty Deed

- Guarantees title only during the seller's term. Use: common in commercial.

- Title Search

- Registry search to find impediments. Usage: essential pre-purchase step.

- Title Insurance

- Title problem insurance. Use: Protects buyer/lender.

- Title Commitment

- Title company commitment after checks. Usage: confidence in closing.

- Survey

- Survey of milestones and boundaries. Use: avoids currency disputes.

- Escrow / Escrow Account

- Transaction custody account. Use: funds/documents until closing.

- Closing Disclosure

- Document with financing rates/conditions. Use: final review before closing.

- Closing Statement

- Statement with all amounts paid/received. Use: proof of closure.

- Purchase and Sale Agreement

- Purchase and sale agreement (price, terms, conditions). Usage: legal basis of the transaction.

Evaluation & Price

- Appraisal

- Estimated value by licensed appraiser. Usage: required by the bank.

- Appraised Value

- Value defined in the appraisal report. Use: basis of the amount financed.

- Broker Price Opinion (BPO)

- Price opinion made by broker. Usage: alternative when appraisal is not necessary.

- Comparative Market Analysis (CMA)

- Estimated price based on recent comparables. Usage: pricing strategy.

Contracts & Clauses

- As-Is Condition

- Sale “as is”. Usage: May require post-purchase repairs.

- Due diligence

- Pre-purchase legal/structural/financial audit. Use: avoid surprises.

- Due-on-Sale Clause

- Requires settlement of debt upon sale. Usage: limits assuming mortgage.

- Escalation Clause

- Offer automatically increases compared to competitors. Usage: contested markets.

- Right of First Refusal

- Right of first refusal to purchase before third parties. Use: common in rentals/condos.

- Lease Option

- Lease with future purchase option. Use: part of the rent becomes a deposit.

- Rent-to-Own

- Rent with option to buy; similar format to above. Usage: accumulate capital gradually.

- Offer

- Formal purchase proposal with terms and contingencies. Usage: opens negotiation.

Ownership & Use

- Single-Family Home

- Single-family house (1 unit). Use: housing or seasonal.

- Multi-Family Home

- Property with multiple units (duplex, etc.). Use: income from multiple rentals.

- Income Property

- Property acquired to generate income. Usage: focus on return.

- Turnkey Property

- Ready to use/rent without renovations. Use: immediate return.

- Fixture

- Fixed item that accompanies the property (e.g. cabinets). Use: unless excluded by contract.

- Homeowners Association (HOA)

- Association that governs community rules/amenities. Usage: may restrict usage/short-term.

- HOA Fees

- HOA fees for maintenance/security/amenities. Usage: consider in total cost.

- Subdivision

- Division of land into lots for development. Use: residential/commercial expansion.

- Land Lease

- Use of land without owning the land. Use: common in commercial.

- Situs

- Legal-economic location of the property. Usage: applicable rules/taxes.

- Zoning

- Local rules of use (residential/commercial/industrial). Use: authorizations and restrictions.

- Easement

- Right of limited use by third parties (access/utilities). Usage: impacts use and value.

- Lien

- Seizure/creditor's right over the property. Usage: needs to be paid off/released.

- Lien Waiver

- Waiver/release of attachment. Use: common in construction/renovations.

- Lis Pendens

- Lawsuit pending against the property. Usage: litigation alert.

Execution & Opportunities

- Foreclosure

- Foreclosure due to default. Use: risk, requires extra due diligence.

- Foreclosure Auction

- Auction of property repossessed by the bank. Use: may have discounts and risks.

- Real Estate Owned (REO)

- Property already repossessed and maintained by the bank. Usage: “as-is” sale, negotiation possible.

- Real Estate Syndication

- Several investors buy/trade together. Use: access to larger projects.

Insurance & Taxes

- Homeowner's Insurance

- Home insurance against damage/loss. Usage: lenders requirement.

- Capital Gains Tax

- Tax on sales profit. Usage: consider treaties and tax residency.

- Depreciation

- Accounting reduction in the value of the asset over time. Use: tax benefit on rent.

- Capital Expenditures (CapEx)

- Improvement/useful life expenses (e.g., roof). Use: Increases value/attraction.

- Capital Improvements

- Relevant improvements that add value. Usage: impact on assessment and taxes.

- Tax Lien

- Seizure for unpaid taxes. Usage: needs to be resolved before closing.

Operation & Management

- In Escrow

- Transaction in progress with amounts in custody. Use: until conditions are met.

- Inspection

- Technical inspection of the property. Use: negotiate repairs/credits.

- Walk-Through

- Final pre-closing inspection. Usage: check combined conditions.

- Maintenance Reserve

- Reserve for maintenance and repairs. Use: prevent surprises at the checkout.

- Holding Period

- Time keeping the asset. Usage: impact on taxes/strategy.

- Pro Forma

- Financial projection (revenue, expenses, return). Usage: decide feasibility.

- Refinancing

- Exchange of the loan for another with new terms. Usage: reduce rate/free up capital.

- Seller Concession

- Seller concession to help with costs. Usage: close the difference at closing.

- Underwater Mortgage

- Mortgage balance > market value. Use: makes it difficult to sell without losses.

- Tenant Screening

- Tenant screening (credit, history). Use: reduce default/risk.

Observation: This glossary is for informational purposes only and is not a substitute for professional legal, tax, or financial advice.

Understand the key real estate terms in the US facilitates decisions and negotiations in the market.

Ready to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025

Thinking about investing: How to make the most of the moment?

Why invest with Jen?

Because I guide you toward your dream—and keep any nightmares far from your path.

360° Consulting

I take care of everything – from planning to searching, from purchasing to financing, from legal structure to post-purchase management.

Selected Partnership Network

I put you in touch with immigration lawyers, accountants, banks and rental property managers I've already tested and approved.

Data & Transparency

I base my recommendations on real metrics of valuation, profitability, and risk, always with updated reports.

Service in Portuguese

I explain each step of the American process in a simple way and without language or cultural barriers.

VIP Availability

You can speak directly to me via WhatsApp or Zoom and receive a response within 24 hours. When you come to Orlando, I will accompany you on each visit.

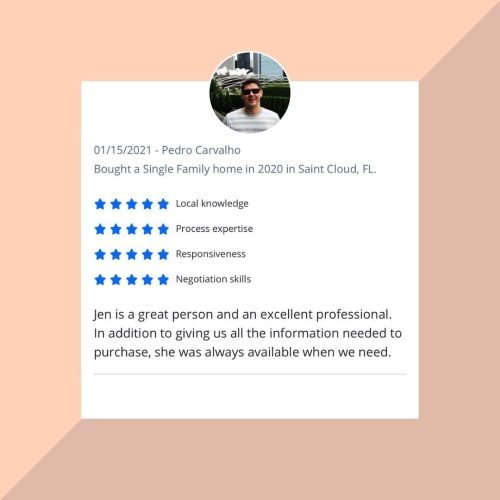

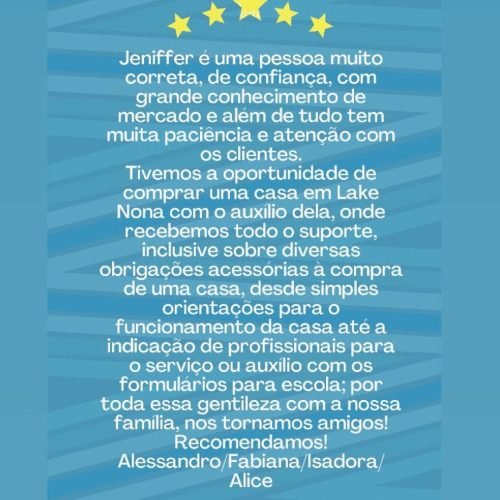

Solid Social Proof

My 5 ★ reviews on Realtor.com and Zillow – and the dozens of Brazilian families I've served – prove my commitment to results.

Stories of Conquest and Satisfaction

Professional Profiles

Check out my profiles on the main real estate portals. Open in new tab.

Social media

Stay up-to-date with daily content about the Orlando market, neighborhood tours, and tips for international buyers.

@jen.dantas — stories, behind-the-scenes footage, and featured properties.

Follow on InstagramYouTube

@corretoradeimoveisemorlando — guides, tours and reviews.

SubscribeJendantasrealtor — posts, events and news.

Like pageTikTok

@jendantasrealtor — quick videos with tips and trends.

Follow on TikTok