Jen Dantas

Orlando real estate broker specializing in the Central Florida real estate market.

- A One Big Beautiful Bill It's now law and a game-changer for real estate investors. See how 100% depreciation and Opportunity Zones can eliminate your taxes.

I have a friend, let's call him Carlos. He's a smart guy, he works hard, and in recent years, he's started investing in real estate.

He did everything rightHe bought some properties, made improvements, and on paper, his depreciation calculations showed large tax "losses." But when tax time came, he called me frustrated.

“Jen,” he said, “I have all these losses on paper, but I’m still paying a fortune in taxes on my salary. It feels like I’m riding through mud.”

Carlos's story is the story of many investors. We entered the real estate game not only for the cash flow, but also for the incredible tax benefits it promises.

The answer to Carlos's problem — and yours — has just arrived.

THE One Big Beautiful Bill, previously a political promise, was signed and is now lawThe tax breaks we hoped for are no longer a possibility; they're a reality that will turbocharge your strategies in a way we haven't seen in a generation.

But, like everything in the tax world, there are crucial details. And some of them can be pitfalls if you're not prepared.

Let's unpack what is fact, as if we were having coffee. No complicated jargon, just what you really need to do right now.

What is the new tax law?

Think of this law as a new “rulebook” for the tax game.

The focus is clear and strong: to encourage investment, construction, and job creation in the US. For us real estate investors, there are five changes that are like five golden cards on the table.

And you need to know each of them to play and win.

The 5 Major Changes You Need to Master NOW

1. The Return of 100% Bonus Depreciation (The “Crown Jewel”)

What is this in practice?

Imagine buying a new car for your business and instead of deducting a little bit of the cost each year, you could deduct the full price of the car in the very first year.

The new law reinstates and makes permanent bonus depreciation of 100% for qualified components of a property.

- The Impact for Investors: This is huge. By purchasing a property and conducting a cost segregation study, you can anticipate decades of tax deductions for Year 1.

- This creates massive “paper losses” that can be used to deduct income from your main job, potentially eliminating your tax bill. It is the most powerful tool to free up capital immediately.

- The Fine Print: The rule applies to properties acquired AND placed in service after January 19, 2025.

If you purchased before that, unfortunately you were left out of this tax party.

Want to learn more about depreciation? Read the article: Property depreciation and tax benefit

2. Section 179 Expansion (The Turbocharged Incentive to Reform)

What is this in practice?

Section 179 already allowed deductions for the costs of certain improvements.

The new law increases the limit of this deduction to almost $1.3 million. It's the government saying:

If you're going to renovate this property and improve the community, we'll give you a nice tax break for it.

- The Impact for Investors: This makes “value-add” projects (buy, renovate and increase value) extremely attractive.

- The cost of a new roof, electrical systems, or major renovations can be deducted immediately, increasing your return on investment and freeing up capital for your next business venture.

3. Opportunity Zones 2.0 (The Magic Vault of Earnings)

What is this in practice?

The law creates a new and permanent round of Opportunity Zones. Think of them as special areas on the map.

If you sell an asset (stocks, other real estate) for a large profit, instead of paying taxes, you can take that money and invest it in a project within these zones.

- The Impact for Investors: It's one of the most powerful tools for deferring and potentially eliminating capital gains taxes. If you hold your Opportunity Zone investment for 10 years, all the appreciation of this new project becomes 100% tax-free.

This directs capital to areas in need of development and offers an unparalleled tax benefit.

4. Permanent Tax Cuts

What is this in practice?

The law makes permanent the lower income tax brackets established in 2017. The highest bracket, for example, will remain at 37% instead of reverting back to almost 40%.

- The Impact for Investors: More predictability and more money in your pocket.

For investors who generate significant cash flow, a lower marginal tax rate means more capital stays with you to reinvest each year.

Simple as that.

5. Section 199A Improvement (The Homeowners' Discount)

What is this in practice?

The Qualified Business Income (QBI) Deduction is a special deduction for many businesses, including most real estate investors.

The law increases this deduction from 20% to 23% on net rental income and makes it permanent.

- The Impact for Investors: It's a direct reduction in your taxable income.

If you have $100,000 of net rental income, instead of deducting $20,000, you now deduct $23,000 before calculating your tax.

That's more money saved, year after year.

Your Action Plan with Jen Dantas: What to Do IMMEDIATELY

The direction is clear and the window of opportunity is open.

Quick and well-advised investors will reap the greatest rewards — especially in the Orlando market, which combines tourism demand, internal migration, and new pro-investment tax rules.

Don't Wait: The worst mistake is to remain defensive. Starting in 2025, a "golden moment" begins to accelerate your dollar portfolio. Planning now means being ahead of the curve when the best properties become available.

Talk to Jen and her CPA: This is not the time for tax improvisation. Schedule a call with Jen Dantas (Click here) and a CPA in the US specializing in foreign investors. Key question: "With the new law in effect, how do we optimize my portfolio for 2025—cash purchases, financing, or a 1031 exchange?"

Review your Capital: Do you have accumulated gains in stocks or cryptocurrencies? Consider realizing some of these profits and redirecting them to properties that generate income in dollars. If you're looking to renovate and resell homes, the new Section 179 offers accelerated depreciation that reduces taxes in the first year.

Take advantage of Opportunity Zones: Orlando and surrounding areas have designated areas Opportunity ZonesInvesting there could mean deferring (or even exempting) capital gains tax — ask Jen for the updated map.

Activate Your Network Now: Connect with construction companies, property managers syndications and funding partners that Jen has already validated. When that one comes up condo with potential of 8 % return or the new phase of short-term rentals in Davenport, you won't waste time "looking for contact"... you'll already have the WhatsApp right.

Next Step: Click here to schedule a 15-minute strategy conversation. Bring your questions, numbers, and goals—Jen will take care of the rest.

The "One Big Beautiful Bill" is no longer a political slogan; it's a positive earthquake in the real estate tax landscape. For my friend Carlos and for all of us, the wave we've been waiting for isn't coming.

She arrived.

Like a good surfer, you need to be on the board, paddling hard to get the best part of it.

Prepare yourself, inform yourself and, above all, act.

Legal Notice: This article is for informational and educational purposes only and should not be construed as tax or financial advice. Tax laws are complex and constantly changing. Always consult a qualified professional, such as a CPA or tax attorney, to discuss your specific situation before making any investment decisions.

Preparing for 2025: How to Seize the Moment?

If you're looking to buy, now's a great time to explore Florida real estate market trends and carefully evaluate your options.

The changing market provides a unique opportunity to make informed decisions and invest in the ideal property, whether for living or investment.

For sellers, a strategic adjustment will be the difference. By setting a realistic price and investing in small improvements, you increase your chances of a quick and profitable sale.

Sources: Data and insights provided by Florida Realtors® and market statistics reports.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Brazilian Real Estate Broker in Orlando Facilitates the Real Estate Buying Process

Buying a property in the US can be challenging, but Jen Dantas, as an expert Brazilian real estate agent, simplifies the process and will take care of everything you need to buy a property in Florida:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

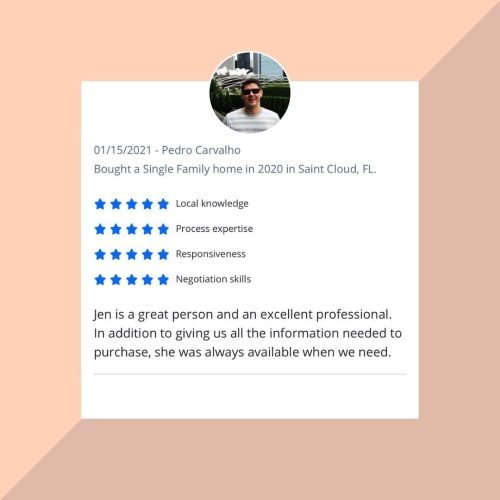

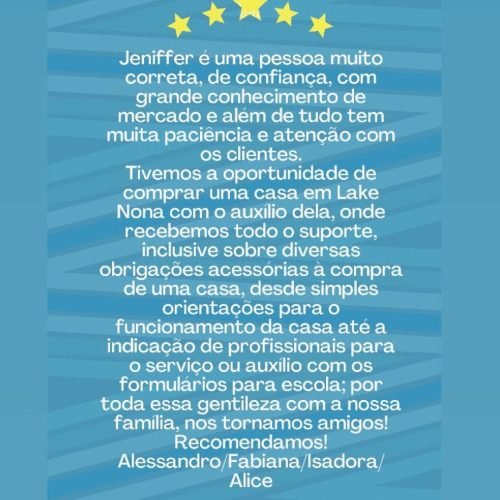

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025