Jen Dantas

Real estate broker in Orlando, specializing in the Florida real estate market.

- Condos or houses in Orlando: find out which is the best option for you. Learn the advantages and disadvantages of each type of property!

If you are thinking about investing in real estate in Orlando, one of the first questions that probably crossed your mind was:

❓ “Should I buy a condo or a single-family home?”

This is a very common question — and the right answer depends a lot on your investor profile and your goals.

I have worked with clients who have had excellent results investing in condos and others who made fortunes with housesEach type of property has its pros and cons — and today I'm going to help you figure out which is the best choice for you!

Condos vs. Houses in Orlando: Which is Best for You? 🤔

The answer depends on what you're looking for. To help you decide, I'll outline the main strengths and challenges of each option.

1. Condos in Orlando: Advantages and Disadvantages 🏢

You condos (or condominiums) are apartments or individual units located within a residential building or complex. These properties typically offer common areas such as a swimming pool, gym, and security.

✅ Advantages of Investing in Condos

✔️ More Affordable Initial Cost: On average, condos are cheaper than houses. The average price of a condo in Orlando is around US$320,000.

✔️ Simple Maintenance: The HOA (Homeowners Association) takes care of the outdoor areas, security and infrastructure — you don't need to worry about the garden, exterior painting or pool.

✔️ Great for Vacation Rentals: Many condos in Orlando and Kissimmee are designed to attract tourists, especially those near Disney.

✔️ Greater Negotiating Power: Condo inventory is higher, creating more opportunities to negotiate discounts.

❗️ Disadvantages of Investing in Condos

❌ High HOA Fees: Condominium fees can vary greatly, ranging from US$150 to US$500/month, impacting its profitability.

❌ Restrictive Rules: Not all condos allow short-term rentals (Airbnb/VRBO), so it's important to check the rules before purchasing.

❌ Longer Selling Time: In 2024, condos took on average 96 days to be sold — longer than houses.

🔎 Jen's Tip: “If you're looking for an investment with low maintenance headaches and want to focus on vacation rentals, a condo near Disney might be perfect for you.”

2. Single-Family Homes in Orlando: Advantages and Disadvantages 🏠

To the single-family homes Single-family homes are independent properties, usually with a yard and garage. They are ideal for families looking for more space or investors looking to profit from long-term rentals.

✅ Advantages of Investing in Homes

✔️ Greater Appreciation: Houses tend to appreciate in value faster than condos. In 2024, the median home price in Florida reached US$420,000, with appreciation of +2,4% compared to the previous year.

✔️ Strong Demand for Long-Term Rentals: Families and professionals moving to Orlando often prefer houses because they offer more space and privacy.

✔️ Minor Rental Restrictions: In many areas of Orlando, houses don't have as many short-term rental restrictions as condos.

✔️ Lower Fixed Rates: Without the HOA fee, you have greater control over fixed costs.

❗️ Disadvantages of Investing in Homes

❌ Maintenance Costs: As a homeowner, you will be responsible for all exterior maintenance, such as landscaping, painting, and roofing.

❌ Highest Starting Price: The average cost of houses is about 30% larger than that of condos.

❌ More Work to Manage: For those living in Brazil, managing maintenance remotely can be challenging—although this can be resolved with specialized companies.

🔎 Jen's Tip: “If you’re looking for long-term value and want to attract families to relocate to Orlando, a house may be your best choice.”

3. What Type of Property Generates the Most Passive Income? 💰

Both types of properties can generate a good passive income, but with important differences:

💰 Condos for Vacation Rentals

✔️ Average profitability of 7.5% per year.

✔️ Best option in tourist regions, such as Kissimmee and Lake Buena Vista.

✔️ Great for attracting families on vacation and small groups.

💰 Houses for Long Term Rental

✔️ Average profitability of 7.1% per year.

✔️ More stable and secure, especially for investors seeking predictability.

✔️ Ideal for families who want to live in the same house for years.

🔎 Jen's Tip: "If you want high profitability with Airbnb, condos near Disney are an excellent choice. If you prefer security and predictability, long-term rentals are better."

4. Which Property is Best for Resale and Appreciation? 📈

When it comes to real estate appreciation, houses typically have a slight advantage. However, this depends largely on location and market trends.

📈 Houses in expanding regions (such as Davenport and Winter Garden) tend to appreciate more quickly.

📈 Condos in tourist areas they have less potential for appreciation, but guarantee an excellent return on seasonal rentals.

🔎 Jen's Tip: "If you're thinking about selling your property in the future, prioritize homes in residential areas or condos near theme parks."

5. How to Choose Between a Condo or House in Orlando? 🤔

The final decision depends on your investor profile and your goals. To help you out, I've put together a quick summary:

✅ Looking for ease of management and high tourist demand? → Choose one condo.

✅ Do you prefer value and security in long-term rentals? → Choose one home.

✅ Want to negotiate a good price now that stock is high? → condos have greater room for negotiation in 2025.

✅ Do you prefer a property with fewer fixed fees? → houses They usually have lower external maintenance costs.

Conclusion: The Best Choice is the One that Meets Your Goals 🚀

The Orlando real estate market is full of opportunities—and so much so. condos as houses can generate significant profits if you know how to choose strategically.

💬 Need help finding the ideal property for you? Call me and let's talk! I'll show you the best options based on your plans and goals. 😉

Read also:

➡️ How to Generate Passive Income in Florida

➡️ Investing in a Vacation Home in Orlando

➡️ Dollarization of Assets with Real Estate in Orlando

2025: The right time to get in the game

If you are looking for smart investing, asset protection and passive income, dollarization of assets with properties in Orlando may be just what you need.

Protect your capital, take advantage of tax advantages, and be part of a globalized market that continues to grow. The time to act is now.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Real Estate Agent in Orlando Makes the Home Buying Process Easier

Buying a property in the US can be challenging, but Jen Dantas, a Brazilian real estate agent in Orlando, simplifies the process and will take care of everything you need to buy a property:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

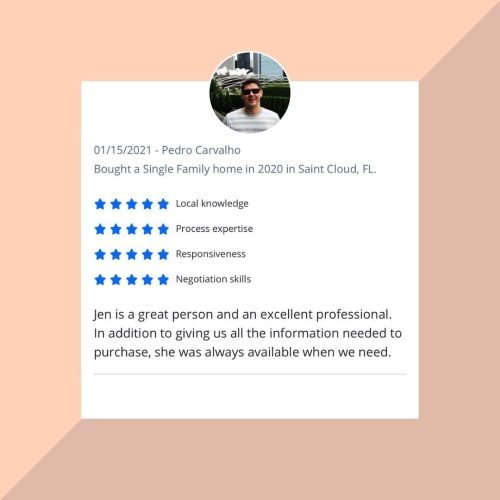

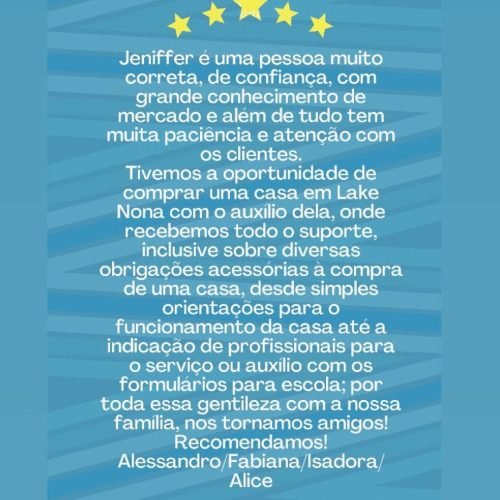

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025