Choosing the right area in Orlando is one of the most important factors for successful real estate investment.

With neighborhoods offering everything from high-end properties to profitable vacation rental options, Orlando has specific areas that cater to different investor profiles.

In this guide, we explore the top neighborhoods to investing in Orlando and surrounding areas, highlighting characteristics, attractions and ideal investment profiles for each location.

By the end, you'll be ready to choose the right region for your investment profile.

THE what you will learn:

– Investment profiles for each of Orlando’s main regions and how they adapt to different financial goals.

– The attractions and amenities that make each neighborhood unique, influencing the potential for appreciation and returns from vacation rentals.

– Details on strategic neighborhoods for investment in Orlando, including regions such as Lake Nona, Winter Park, Kissimmee, and Celebration.

– How to choose the right neighborhood to maximize returns and meet your real estate investment profile.

Top neighborhoods to invest in (with profiles and attractions)

Apopka

Natural environment with parks and reserves. The city has been expanding with new residential and commercial developments.

Investment profile: families, good infrastructure and potential for appreciation.

Nearby attractions: Wekiwa Springs State Park and Lake Apopka.

▸ See more

For those who want investing in real estate in Orlando With a focus on quality of life and a balanced budget, Apopka offers homes with spacious lots and access to nature. It's a great choice for buy & hold (long term) with moderate risk.

Tip: Consider commuting and HOA costs. Areas near major thoroughfares (414/429) tend to have better resale liquidity.

Celebration

Created by Disney, a planned and charming city, with unique architecture and complete leisure facilities.

Investment profile: season and resale; attracts residents and tourists.

Nearby attractions: Disney World and Downtown Celebration.

▸ See more

The brand appeal and urbanism make Celebration a highlight for those seeking differentiation in investing in real estate in Orlando. The ticket price tends to be higher, but the perception of value sustains demand.

Keep an eye on local rules for short-term rentals (they vary by area) and the cost of amenities/HOA when calculating your cap rate.

Clermont

Hills and lakes, calm climate and constant growth.

Investment profile: long-term residential, focus on appreciation.

Nearby attractions: Lake Louisa State Park and Waterfront Park.

▸ See more

In the long term, the combination of nature and the supply of new developments favors families and remote workers. A good balance between square footage and price per square foot.

Evaluate commute routes and schools. condominiums, check the rental policy before projecting income.

Davenport

This season's favorite, with many condominiums and good value for money.

Investment profile: short season, high occupancy due to proximity to parks.

Nearby attractions: Disney, golf courses and resorts.

▸ See more

To investing in real estate in Orlando With a focus on income, Davenport offers a large inventory of 4–6 bedroom homes with amenities competitive with Airbnb/VRBO.

Check STR rules by community, cleaning/management costs, and seasonality (rate card) when projecting NOI.

Dr. Phillips

Premium infrastructure, award-winning restaurants and easy access to attractions.

Investment profile: high standard, long-term rental and appreciation.

Nearby attractions: Restaurant Row, International Drive and Universal Studios.

▸ See more

Solid liquidity for those considering real estate. Higher average ticket, but qualified demand and historically low vacancy rates in long-stay rentals.

Compare municipal taxes and HOAs between subdivisions; proximity to good schools impacts resale value.

Gotha

Small residential area, quiet environment and proximity to commercial areas.

Investment profile: stability and moderate appreciation.

Nearby attractions: near Windermere and Dr. Phillips.

▸ See more

A good choice for those who prioritize housing and cost predictability. investing in real estate in Orlando with a family focus, it is a “sweet spot” between price/area.

Map distance to markets and arterial roads — improves attractiveness to long-term renters.

Kissimmee

Proximity to Disney and tourist infrastructure guarantee high occupancy.

Investment profile: short season (vacation homes).

Nearby attractions: Disney World, Old Town and Lake Tohopekaliga.

▸ See more

Broad market for homes with pools and resort amenities. Ideal for diversifying income in dollars via STR.

Work with professional management (cleaning/maintenance) and a clear fee policy to protect your NOI.

Lake Nona

“Medical City”: modern infrastructure focused on health and technology.

Investment profile: attracts professionals and families; potential for residential/commercial appreciation.

Nearby attractions: Lake Nona Medical City and USTA National Campus.

▸ See more

To investing in real estate in Orlando With a 5–10-year horizon, Lake Nona balances safety, schools, and service offerings, reducing long-stay vacancies.

Pay attention to HOA fees and location within the master plan — proximity to the Town Center usually increases liquidity.

Minneola

Quiet and growing city, with new residential areas and a family atmosphere.

Investment profile: long term and gradual appreciation.

Nearby attractions: close to Clermont, with parks and leisure facilities.

▸ See more

Ideal for those who want to start investing in real estate in Orlando prioritizing more affordable price per square foot, without sacrificing quality of life.

Check access routes and nearby schools; in new subdivisions, compare rates and construction schedules.

St. Cloud

Small town atmosphere, great public spaces and contact with nature.

Investment profile: residential close to tourist areas.

Nearby attractions: Lakefront Park and East Lake Tohopekaliga.

▸ See more

Good option for stable long-term income, with an entry fee generally lower than premium areas.

Evaluate travel costs and service offerings by district to gauge the attractiveness of the location.

Sunbridge

Masterplan south of Orlando, focusing on sustainability and green spaces.

Investment profile: long term in a planned area.

Nearby attractions: planned trails and parks.

▸ See more

For those aiming for gradual appreciation, planned projects tend to deliver urban predictability and attractive amenities.

Compare delivery timelines, masterplan phases, and HOA/CDD structure before closing.

Windermere

Luxury with mansions and proximity to lakes; a peaceful, family-friendly atmosphere.

Investment profile: high standard and consistent appreciation.

Nearby attractions: Butler Chain of Lakes; access to Dr. Phillips.

▸ See more

Excellent for consolidating wealth. This market is for discerning buyers, but willing to pay for location and amenities.

Analyze recent comparables and lot features (lake view, solar orientation) — these have a strong impact on price.

Winter Garden

Charming historic center with new residential and commercial areas.

Investment profile: high residential demand and good appreciation (long term).

Nearby attractions: Winter Garden Village and West Orange Trail.

▸ See more

The perfect mix of lifestyle and access to services, which helps with resale liquidity and long-stay occupancy.

Consider traffic and access to major thoroughfares; properties near the historic downtown area have extra appeal.

Winter Park

Historic charm, culture, and tree-lined streets; sophisticated profile.

Investment profile: high standard, high value and long-term rental.

Nearby attractions: Park Avenue, Rollins College and Winter Park Chain of Lakes.

▸ See more

For those who prioritize prestige and solidity, Winter Park delivers consistent demand and high ticket prices—ideal for consolidating your portfolio.

Properties with walkability and proximity to cultural hubs tend to perform better in resale.

Read also:

➡️ How to Generate Passive Income in Florida – Tips for profiting by choosing neighborhoods with high demand.

➡️ Orlando Real Estate Market: Lessons from 2024 – How market behavior can influence these regions.

➡️ Buying Properties for Rent in Orlando – Guide for those who want to invest with a focus on passive income.

Exploring the ideal area in Orlando can increase your return on investment.

Each neighborhood has unique characteristics that cater to different profiles, and these are the most sought after by Brazilians today.

Ready to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

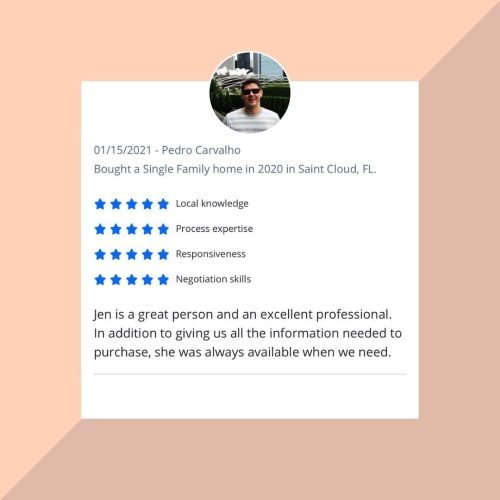

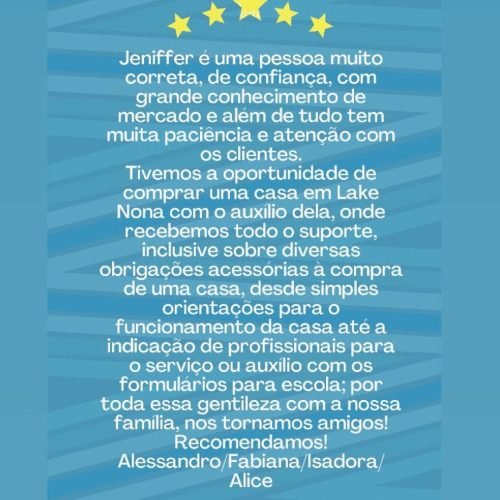

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025