Orlando 2026: o “Big Bang” do Mercado Imobiliário

This content delves deeper into Complete Orlando Guide It brings together practical signals, demand analysis, and positioning. Note: Some numbers are time-sensitive; validate specific data at the time of decision.

📌 Orlando real estate market: what drives the game

- Demand pressure 1,500 new residents/week

- Infrastructure and projects US$ 50 bi

- Creative Village (Downtown) US$ 1.5 bi

- Anchor Health (AdventHealth) US$ 660M

- Autonomous mobility 100% autonomous taxis

🔥 The data that explains the pressure

Orlando isn't "growing": it's being driven by demand. A simple fact explains the pressure: about 1,500 new residents per week.

This is the type of metric that helps to understand liquidity and resale time by aisle.

🎯 Strategic Shortlist (Investor)

The market is vast, but golden opportunities are rare.

Receba meu Shortlist Estratégico: 3 a 5 propriedades selecionadas com base em liquidez, proximidade tecnológica e valorização real.

Want to access the Strategic Shortlist?

👉 I want to accessForget everything you knew about Orlando by 2025.

A cidade que você conhecia como “o destino das férias em família” deixou de existir. Em 2026, entramos no que os analistas chamam de “Big Bang Imobiliário”: o ponto de colisão exato entre uma infraestrutura de US$ 50 bilhões, tecnologia autônoma de ponta e uma migração de riqueza sem precedentes.

We're not talking about gradual growth. We're talking about a definitive change in scale.

Orlando está “dando voltas” em metrópoles consagradas como Austin, Miami e Las Vegas. Com 1.500 novos residentes chegando por semana, a equação é simples e cruel: a pressão sobre o inventário atingiu o nível crítico. O tempo de “esperar para ver” acabou.

Orlando acaba de conquistar a “Tríplice Coroa”: lideramos a América do Norte em crescimento de empregos, crescimento populacional e crescimento do PIB nominal. Ignorar esses dados não é cautela; é cegueira financeira.

Those who hesitate now will pay the price later.

O que é o “Big Bang” de 2026? (O dinheiro não mente)

This term isn't marketing. It's financial mathematics.

Após anos de demanda reprimida por taxas de juros, 2026 marca o destravamento total do crédito e dos grandes projetos. Como o desenvolvedor Craig Ustler alertou: “Bom desenvolvimento gera bom desenvolvimento”.

📝 Note

Craig Ustler is a prominent real estate developer and third-generation Orlando resident, known for his transformative urban revitalization projects in downtown Orlando. He owns and chairs Ustler Development, Inc. and serves as the lead developer on major initiatives such as Creative Village, a US$1.5 billion project.

As gruas que dominam o horizonte de Downtown, Lake Nona e Horizon West são bandeiras plantadas por investidores institucionais que já fizeram suas apostas. Orlando acaba de conquistar a “Tríplice Coroa”: lideramos a América do Norte em crescimento de empregos, crescimento populacional e crescimento do PIB nominal. Ignorar esses dados não é cautela; é cegueira financeira.

The 3 Signs That the Game Has Changed

The transformation has moved beyond spreadsheets and is already on the asphalt:

🚗 The Waymo Revolution

Orlando entrou no clube exclusivo das 10 cidades globais com táxis 100% autônomos. Isso altera a lógica de valorização: a distância física perde relevância para o “tempo produtivo”.

⚙️ The New Money (High Income)

With Siemens Energy moving its headquarters to Lake Nona and the semiconductor hub in Neo City attracting giants from South Korea, the tenant profile has changed. We're talking about engineers and executives with six-figure salaries seeking long-term leases.

🎢 Entertainment as an Anchor

The Epic Universe and Disney's technological expansions are not just theme parks. They are guarantees of perpetual flow that shield the Vacation Homes market against any external instability.

The Treasure Map: Where the pressure explodes first

The system of promotion is not democratic. It favors those who position themselves in the right corridors before the masses.

O Corredor de Inovação (Lake Nona ↔ Neo City): Onde o “smart money” dorme. O investimento de US$ 166 milhões em terras no Wellness Way prova que o crescimento para o sul e sudeste é imparável.

O Eixo Walkable (Downtown & Winter Park): O novo luxo é não precisar de carro. Projetos como West Court e Midtown (US$ 2B) estão criando o “efeito Manhattan” no coração da Flórida.

A Fronteira do Lucro (Ocoee & Clermont): Aqui está a assimetria. Com o novo Dynasty Sports Complex de US$ 1 bilhão e a expansão de Wellness Way, você ainda encontra preços de entrada racionais com potencial de explosão nos próximos 24 meses.

Projects mentioned and the "why" (quick read)

Editorial organization of what already appears in the text (without additional promises).

| Theme/Project | Where does it appear on the map? | Practical impact on the property |

|---|---|---|

| Waymo (autonomous taxis) | Mobility | Productive time ↑; distance weighs less in the decision and in the price. |

| Siemens Energy (Lake Nona) | Innovation Corridor | Demand for annual rentals (high income profile) ↑. |

| Neo City (semiconductors) | Lake Nona ↔ Neo City | Locking in qualified demand in technology hubs. |

| Epic Universe/Disney expansions | Entertainment | Steady flow into vacation homes (more resilient occupancy). |

| West Court / Midtown | Downtown & Winter Park | Walkable premium: liquidity and appreciation in micro-locations. |

| Dynasty Sports Complex | Ocoee & Clermont | Asymmetry: more rational entry with wave repricing. |

Housing vs. Investment: Distinct Strategies

In 2026, surgical precision triumphs over generalization.

For Living (Protected Lifestyle): The focus is on Horizon West and areas with new road connectors (such as the 417). You buy quality of life today and guarantee resale liquidity tomorrow for the 75,000 new residents who will arrive by 2030.

Para Investir (Renda Inteligente): O amadorismo morreu. Para vencer a rede hoteleira, sua Vacation Home precisa de design e experiência. No aluguel anual, siga os polos de saúde: imóveis próximos à nova torre de US$ 660M do AdventHealth terão vacância zero.

Jen Dantas Selection Protocol

O mercado está cheio de ruído. Meu trabalho é filtrar o sinal e entregar o lucro. Não apresento “casas bonitas”; apresento ativos validados por um checklist rigoroso:

✅ Exit Liquidity (Exit Strategy)

“Se precisarmos vender em 3 anos, quem é o comprador?” Se a resposta não for um americano de alta renda, eu não recomendo.

🧭 Audit of the Future

I'm analyzing whether today's quiet street will become the noisy traffic corridor of 2027 due to the planned infrastructure projects.

📑 HOA Forensics

I read the fine print. Does the condominium allow the exact strategy you want to apply? I anticipate the legal problem before it becomes a loss.

FAQ: Questions that will define your success in 2026

1. Are there still opportunities in 2026, or have I missed the boat?

2. New Homes or Resale?

How do I evaluate this in practice? (Jen Dantas)

I don't choose neighborhoods based on "reputation." I consider both objective (living/investing), mobility, liquidity, condominium/HOA rules, and real demand. During visits and negotiations, I observe: micro-location, street profile, noise/traffic, maintenance standards, condominium composition, and exit potential (resale). As a broker with an international perspective, my mission is to translate the chaos of the American market into secure property for you.

Quick acronyms & terms (without complicating things)

HOA: Condominium association (rules + fees).

SUN: Days on Market.

ft²: unit of area used in the USA.

Resale: Resale property (not new).

Walkable: A region where you can get everything done on foot.

Do you want to align neighborhood, strategy, and liquidity with security?

👉 Talk to me📚 Read also

Real Estate Market in Orlando

Prices, trends and demand analysis by region.

Schools in Orlando

Zones, performance, and tips for new families.

Where to Eat in Orlando

Restaurants categorized by style, region, and price range.

Leisure in Orlando

Parks, culture, and excursions beyond the obvious.

Health in Orlando

Hospitals, clinics, and how to choose the most convenient option.

Thinking about investing: How to make the most of the moment?

Why invest with Jen?

Because I guide you toward your dream—and keep any nightmares far from your path.

360° Consulting

I take care of everything – from planning to searching, from purchasing to financing, from legal structure to post-purchase management.

Selected Partnership Network

I put you in touch with immigration lawyers, accountants, banks and rental property managers I've already tested and approved.

Data & Transparency

I base my recommendations on real metrics of valuation, profitability, and risk, always with updated reports.

Service in Portuguese

I explain each step of the American process in a simple way and without language or cultural barriers.

VIP Availability

You can speak directly to me via WhatsApp or Zoom and receive a response within 24 hours. When you come to Orlando, I will accompany you on each visit.

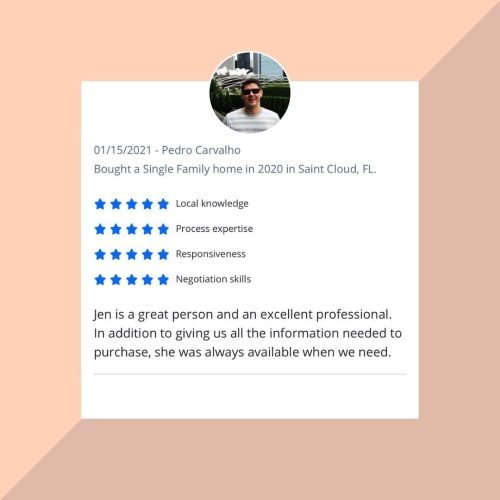

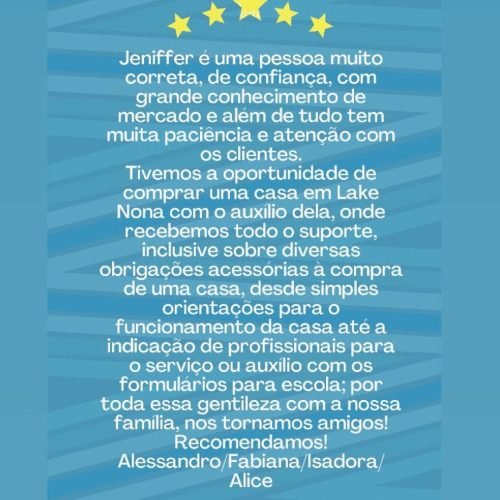

Solid Social Proof

My 5 ★ reviews on Realtor.com and Zillow – and the dozens of Brazilian families I've served – prove my commitment to results.

Stories of Conquest and Satisfaction

Professional Profiles

Check out my profiles on the main real estate portals. Open in new tab.

Social media

Stay up-to-date with daily content about the Orlando market, neighborhood tours, and tips for international buyers.

@jen.dantas — stories, behind-the-scenes footage, and featured properties.

Follow on InstagramYouTube

@corretoradeimoveisemorlando — guides, tours and reviews.

SubscribeJendantasrealtor — posts, events and news.

Like pageTikTok

@jendantasrealtor — quick videos with tips and trends.

Follow on TikTok