This article delves deeper into my Complete Guide to Clermont and brings my practical reading of the real estate market in Clermont in 2025 — with data, trends and real experiences with Brazilian families. Time-sensitive info: Numbers are estimates; please confirm before deciding.

📌 Real estate market overview in Clermont (2025)

Clermont, in Lake County, has established itself as a sought-after suburban city for those looking to live or invest near Orlando. I've seen several Brazilian families buy homes here—both as permanent residences and second homes.

What makes Clermont so attractive? Space, tranquility, good schools, and prices that are generally more affordable than in Orlando's more central areas. By 2025, I see a more balanced market, with a larger housing inventory and good negotiating opportunities.

📊 Real estate market data in Clermont (2024/2025)

| Indicator | Approximate value | Observations |

|---|---|---|

| Average selling price | US$ 425,000 – US$ 455,000 | Standard single-family homes in communities established. |

| Typical listing price | US$ 470,000 – US$ 500,000 | Sellers' initial expectations are usually above the closing price. |

| Price per square foot | US$ 225 – US$ 245 (≈ US$ 2,420 – 2,640/m²) | New or central neighborhoods are at the top of the range. |

| Average time on market | 30 – 60 days | Well-located or new homes sell faster. |

| Inventory | On the rise in 2025 | More options, favorable scenario for the buyer. |

With larger inventory, buyers gain negotiating power. I've seen discounts of 3% to 5% and bonuses from builders—something rare in previous years.

🏠 Types of properties in Clermont and profiles I serve

Single-family homes (SFH)

3–5 bedrooms, backyard, and garage. Suitable for families looking for space.

Planned Communities (HOA)

Ex.: Legends, Heritage Hills, Greater Hills — complete leisure and security.

New buildings

Focus on South Clermont: modern floor plans, energy efficiency, and customization.

Townhomes

~US$ 320,000 – 380,000. Good gateway.

Luxury homes

Above ~US$ 700,000; can exceed US$ 1M in premium communities.

In practice, many foreigners are captivated by new construction. I always compare it to established communities, where costs tend to be more predictable.

💸 Property maintenance costs in Clermont

HOA (Homeowners Association)

~US$ 80 – 250/month, depending on the community infrastructure.

Property Tax

~1.1%–1.3% per year. Ex.: US$ 450,000 house ⇒ ~US$ 5,000/year.

Home insurance

~US$ 1,800 – 3,000/year, varying by coverage.

I include these items in the investment simulation to avoid future surprises.

🗺️ Featured Communities in Clermont

Legends

Large houses, golf course and good liquidity.

Heritage Hills

Active adults (55+), complete leisure and easy maintenance.

Greater Hills

Great value for money; close to schools and shops.

South Clermont

New developments; strong presence of construction companies.

I adapt the selection according to the buyer's lifestyle and expected value.

🔁 New vs. Used Properties: Which to Choose in Clermont?

New (construction)

Modern, efficient, and require less initial maintenance — but are more expensive per square foot.

Used (established communities)

More stable prices, larger lots, and generally lower HOAs.

I've seen clients save around US$$ 30,000 by choosing well-maintained pre-owned homes in the same size.

📈 Liquidity and market valuation of Clermont in 2025

- Some areas have dropped ~2–5% since 2020–2022 peaks.

- Premium communities remain stable.

- Houses below the median sell faster.

- Luxury properties can take months to close.

For long-term investors, I see 2025 as a good entry window: more adjusted prices and greater choice.

👥 Buyer Profile in Clermont (What I Observe)

Resident families

They look for schools, backyards and peace for their daily lives.

Long-term investors

Bet on traditional rental, supported by stable demand.

Foreigners (includes Brazilians)

Permanent or secondary residence with a focus on security and quality of life.

📂 Real examples of negotiations I've followed

Townhome — South Clermont

~US$ 350,000, with free trim upgrades.

Home — Greater Hills

~US$ 430,000, below listing price, appliances included.

Home — Legends

~US$ 750,000, purchase focused on future community appreciation.

If you are thinking about investing or buying your home in Clermont, talk to me. I can present you with updated options, simulate costs, and guide you through each step.

👉 Talk to me❓ Frequently Asked Questions about the Clermont Real Estate Market (2025)

How much does it cost to maintain a home in Clermont (HOA, property tax, and insurance) in 2025?

What is the average home sale price in Clermont in 2025?

How much does it cost per square foot (price per sq ft) in Clermont?

What is the average selling time in Clermont?

Is it worth investing in the Clermont market in 2025?

What communities are trending for buying in Clermont?

Is it possible to negotiate bonuses and discounts on new construction in Clermont?

📚 Read also

Complete Guide to Clermont

Overview for those thinking of living or investing.

Schools in Clermont

Public, private and zoning by address.

Where to Eat in Clermont

Restaurants by style and price range.

Leisure in Clermont

Parks, trails, shopping and local tours.

Health in Clermont

Hospitals, urgent care and specialized clinics.

Thinking about investing: How to make the most of the moment?

Why invest with Jen?

Because I guide you toward your dream—and keep any nightmares far from your path.

360° Consulting

I take care of everything – from planning to searching, from purchasing to financing, from legal structure to post-purchase management.

Selected Partnership Network

I put you in touch with immigration lawyers, accountants, banks and rental property managers I've already tested and approved.

Data & Transparency

I base my recommendations on real metrics of valuation, profitability, and risk, always with updated reports.

Service in Portuguese

I explain each step of the American process in a simple way and without language or cultural barriers.

VIP Availability

You can speak directly to me via WhatsApp or Zoom and receive a response within 24 hours. When you come to Orlando, I will accompany you on each visit.

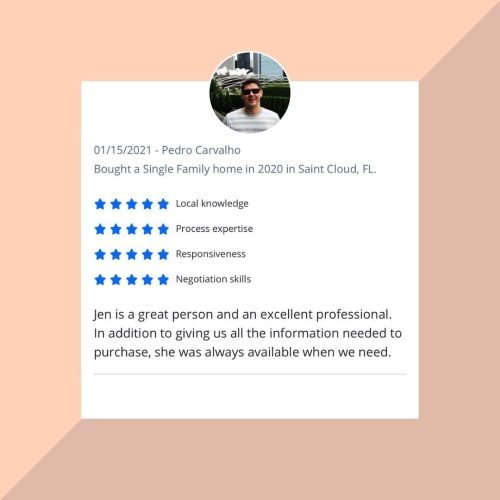

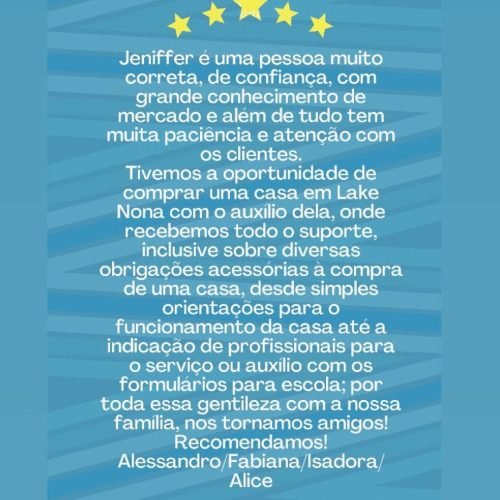

Solid Social Proof

My 5 ★ reviews on Realtor.com and Zillow – and the dozens of Brazilian families I've served – prove my commitment to results.

Stories of Conquest and Satisfaction

Professional Profiles

Check out my profiles on the main real estate portals. Open in new tab.

Social media

Stay up-to-date with daily content about the Orlando market, neighborhood tours, and tips for international buyers.

@jen.dantas — stories, behind-the-scenes footage, and featured properties.

Follow on InstagramYouTube

@corretoradeimoveisemorlando — guides, tours and reviews.

SubscribeJendantasrealtor — posts, events and news.

Like pageTikTok

@jendantasrealtor — quick videos with tips and trends.

Follow on TikTok