Jen Dantas

Orlando real estate broker specializing in the Central Florida real estate market.

- Discover the truth about the dollar in 2025: why optimistic forecasts fail, factors weakening the real, and how to dollarize your assets. Practical analysis!

The Truth About the Dollar

Hey, picture this: you're at a barbecue with a friend who just got back from a trip to the United States, and he won't stop talking about how he bought a house in Orlando to rent out and now receives income in dollars every month.

You laugh, but you keep thinking:

“Does this make sense for my pocket, with the real fluctuating so much?”

I've had conversations like this countless times, and after years of poring over economic reports and exchanging ideas with investment clients, I've realized that dollarizing wealth is not just for the rich – is a practical strategy for those who want to protect themselves.

Let's have an open chat about the dollar, the real, and why investing in real estate in the US could be the right path now in 2025, as if I were explaining it to you right here.

I'll combine what I've seen in recent research with real stories I've heard from friends and companies, to make everything more concrete.

The Predictions That Let Us Down

You know when you see analysts from big banks releasing projections that seem infallible?

For example, an American bank adjusting its dollar forecast to R$ 5.10 by the end of this year, saying the real is strong due to high interest rates and a calmer global outlook. I remember well, at the beginning of 2025, when the dollar was at R$ 6.07, and the same bank was talking about a 5% appreciation.

Today, July 15th, with the price hovering around R$ 5.55, they're revising it downward. It's as if they're going with the flow: if it rises, they project higher; if it falls, they project lower.

It doesn't stop there.

Economists like Fernando Ulrich, who excels at political analysis, also fall for this. Recently, in posts and videos, he has been discussing the dollar possibly returning to R$ 4.70, based on fair price metrics.

He cites fiscal improvement in Brazil, but looking at the numbers, it's doubtful. The primary balance improved slightly with higher taxes, but the nominal balance—including debt interest—remains a mess.

I spoke to a friend who manages a fund in São Paulo, and he said:

"Man, we see this all the time. These projections are for their hedges, but for the average guy, it's like predicting the weather."

He burned money last year following a similar tip, predicting the dollar at R$ 4.70 and ending above R$ 6.

The thing is this bias: institutions make serious mistakes in volatile variables such as inflation, interest rates and exchange rates.

They adjust for the moment, ignoring the long term. If you buy into this idea, you end up getting in at the peak or getting out at the bottom.

Lesson: Focus on the facts, not the flashy headlines.

What's Going On in Brazil? The Factors Weighing on the Real

Looking from here, between Winter Garden and Lake Nona, Brazil is showing some glimpses of improvement, but nothing game-changing.

Gross debt is already around 76 % of GDP and is expected to surpass 79 % in 2025—a three-point increase per year, right on track for a historic record. This raises a red flag for outsiders.

Inflation projected for 2025 is 5.1 percent per square inch, almost double the Central Bank's target. By contrast, the US closed June at 2.7 percent per square inch.

Result: the real melts faster than the dollar.

The exchange rate doesn't help either. The flow is negative: fewer dollars come in than go out, the trade balance loses momentum.

A trader client of a soybean exporter in Mato Grosso confided in me:

“Last year we surfed high prices, but now, with the fall in commodities and the threat of 50 % tariffs that Trump keeps raising, the dollar is shaking everything up.”

The real even gained momentum via carry trade—this short-term capital attracted by high interest rates (Selic vs. Fed)—but all it takes is a geopolitical or electoral sneeze for the money to evaporate.

Productivity? Here in the US, GDP continues to grow, while Brazil is still struggling.

And political risk remains in the rearview mirror: Changing the government doesn't guarantee a miracle. Let's recall 2019-2021, when the real plummeted from R$ 3.80 to over R$ 5, even with an economic "super-minister."

A fund manager told me about clients who bet heavily in reais expecting a political shift; they took a hit when the fiscal policy turned sour.

From the perspective of those who invest in dollars, the balance sheet remains simple: growing debt, stubborn inflation, a volatile exchange rate, and stagnant productivity make for a difficult cocktail to swallow.

Until proven otherwise, the real will continue to be a risky – and expensive – asset.

The Strength of the Dollar That Nobody Wants to See

Despite the chaos, the dollar hasn't faltered. Quite the contrary. Even with rising US debt and talk of inflation under Trump, investors are flocking to the country.

Look at Money Market Funds breaking fundraising records—like short-term fixed-income funds, attracting billions with interest rates of 4.5%. This demonstrates confidence: everyone is buying US debt, with spreads widening for other credits.

An analyst I've been following for a while, Richer Hittenban, uses models to break down factors. He shows that the recent drop in the dollar against the real (from R$ 6.30 in December to now) stemmed more from "sentiment"—the positioning of major players—than from fundamental changes.

It's short-term. The dollar remains the global reserve, the primary medium of exchange, and the US depreciates its currency less.

I saw it in practice: During the pandemic, friends in importing companies suffered with the high dollar, but those who had dollarized assets, such as real estate here in Orlando, were saved.

True story: An e-commerce startup I informally helped in Orlando ignored warnings about the real's devaluation in 2024. They kept everything in reais, betting on "tax improvements."

The dollar rose, import costs soared, and they nearly went bankrupt. Now, they've diversified into US real estate and are feeling more at ease.

How to Protect Yourself by Dollarizing Real Estate in the US

If you see the signs—Brazil's public finances deteriorating, the real slipping, the dollar strong in the long term—the lesson is simple: diversify part of your wealth into assets that generate cash in hard currency.

It's not an alarm; it's balance.

The most direct vehicle? Real estate in the USA

Revenue and equity linked to the dollar. Purchase in dollars, rent in dollars, appreciation in dollars.

Low entry barrier for Brazilians. There are no ownership restrictions; just take care of the legal structure (LLC, trust, or direct title) and taxes.

| Indicator | Current numbers | Source |

|---|---|---|

| Markets with price increases in Q1 2025 | 83 % of the 228 monitored regions | National Association of REALTORS® |

| National average home value | US$ 366 289 | Zillow |

| National average rent | US$ 2 049 / +3.2 % YoY | Zillow |

| New listings | +4.5 % YoY (stock improving) | Zillow |

| Typical mortgage payment | US$ 1 922 / month (20 % down payment) | Zillow |

In Florida, the tourism-domestic migration combo maintains resilient demand even with high interest rates. Orlando, in particular, boasts:

Economic diversification (health-tech in Lake Nona, theme parks, logistics).

Gross profitability still above the national average, especially in Polk County and the suburbs south of I-4.

High liquidity: Mid-tier properties go into contract quickly.

Real case — dollar covering the real's fall

A Rio de Janeiro logistics entrepreneur said he started modestly with a vacation home in Kissimmee. Today, he reaps an annual yield of 5-7 %, in addition to increased asset value.

When the real sank during the 2022 elections, dollar income offset the loss of investments in Brazil.

Risks? Of course.

Interest cycles still volatile: refinancing early is prudent.

Local regulation (short-term rentals in some counties) require due diligence.

Migratory demand: A sharp shift in US immigration policy could slow things down in Florida.

But if you already live in dollars — or want to protection against Brazilian inflation of +5 +% — it makes sense to have part of your portfolio in assets that pay bills in the same currency you spend.

Final question: If debt and inflation in Brazil continue to rise, do you want everything exposed to the real? Or would you rather anchor a portion of your assets in bricks and mortar that generate cash in hard currency?

Preparing for 2025: How to Seize the Moment?

If you're looking to buy, now's a great time to explore Florida real estate market trends and carefully evaluate your options.

The changing market provides a unique opportunity to make informed decisions and invest in the ideal property, whether for living or investment.

For sellers, a strategic adjustment will be the difference. By setting a realistic price and investing in small improvements, you increase your chances of a quick and profitable sale.

Legal Notice: This article is for informational and educational purposes only and should not be construed as tax or financial advice. Tax laws are complex and constantly changing. Always consult a qualified professional, such as a CPA or tax attorney, to discuss your specific situation before making any investment decisions.

Did you know?

It is possible to finance real estate in the United States with your income and documents from Brazil, without bureaucracy and with attractive interest rates.

How a Brazilian Real Estate Broker in Orlando Facilitates the Real Estate Buying Process

Buying a property in the US can be challenging, but Jen Dantas, as an expert Brazilian real estate agent, simplifies the process and will take care of everything you need to buy a property in Florida:

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Prequalification and financing: Jen offers comprehensive financing support, with financial partners that serve international clients.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- Documentation and legal support: From document review to contract closing, Jen and her team ensure every step is compliant with US law.

- After-sales support: Jen's commitment goes beyond the purchase. She offers after-sales support, helping with administration, leasing, and other customer needs.

Want to learn more about the Orlando real estate market? Explore our complete guide for investors and get an in-depth view of all the stages, from choosing the property to closing the contract.

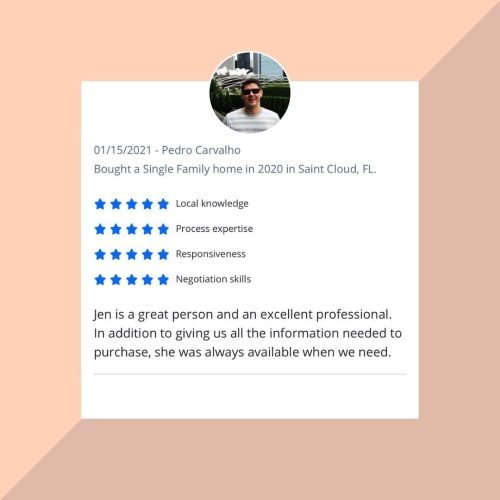

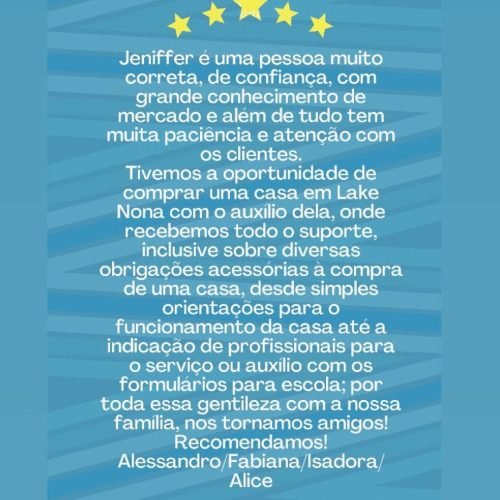

Stories of Conquest and Satisfaction

Complete Guide to Investing in Orlando Real Estate 2026

Celebration: The Dream Neighborhood in Florida

Winter Park Orlando: The Charm of Living in a Historic City

Lake Nona Orlando: The Future of Quality of Life and Innovation in Florida

Is investing in a vacation home in Orlando still worth it in 2025?

Investment in the United States Real Estate Market in 2025